Updated: Dec 30, 2025

#ad disclosure: This post may contain affiliate links. We’re an informational resource (not an operator). 18+ only. Bet legally where permitted and play responsibly. See: Advertising & Affiliate Disclosure • Responsible Gambling.

This is our Affiliate Year in Review 2025 — a year‑end report built for publishers, affiliate managers, and operator marketers who want a clean recap of what actually moved performance in 2025. Importantly, we focus on things you can operationalize: market signals, tracking shifts, KYC/payment friction, and content formats that convert.

Data note: We reference the latest public releases available at time of writing. For example, NJ figures are shown through Nov 2025, Ontario uses monthly tables through Nov 2025, and the UKGC operator snapshot is covered through Sep 2025.

Quick jumps: Snapshot • Numbers • Tracking • Conversion • Content Spikes • Rankings • 2026 Playbook • Sources

Affiliate Year in Review 2025: the one‑page snapshot

If you only read one section, make it this. In 2025, affiliates won by shipping cleaner funnels, not by chasing “more clicks.” As a result, fast pages, clearer offer terms, and better tracking hygiene produced more stable EPCs.

2025 in 12 practical takeaways

- First, regulated iGaming markets kept compounding, especially in Q4.

- Meanwhile, tax and compliance pressure increased in several regions, which pushed operators to protect margin.

- Therefore, offer quality and retention mattered more than raw signup volume.

- Additionally, server-side tracking moved from “nice-to-have” to default for high-value funnels.

- In practice, GA4 hygiene (clean events, dedupe, stable UTMs) became a competitive advantage.

- At the same time, payments and payout expectations turned into a conversion lever, especially on mobile.

- Notably, KYC friction moved earlier in many journeys, so “KYC expectations” copy reduced rage‑quit drop-offs.

- On the content side, long-form hubs with subpages outperformed one-off posts during peak weeks.

- Furthermore, live-bet education converted better than generic odds explainers.

- Because of that, trust signals (terms clarity, disclosures, RG links) became a real growth factor.

- Still, brand ambassador campaigns worked best when product UX + onboarding were strong.

- Finally, 2026 looks less forgiving: compliance + attribution + retention will matter even more.

Key numbers to remember (latest public snapshots)

| Market | What we track | Latest snapshot | Why affiliates should care |

|---|---|---|---|

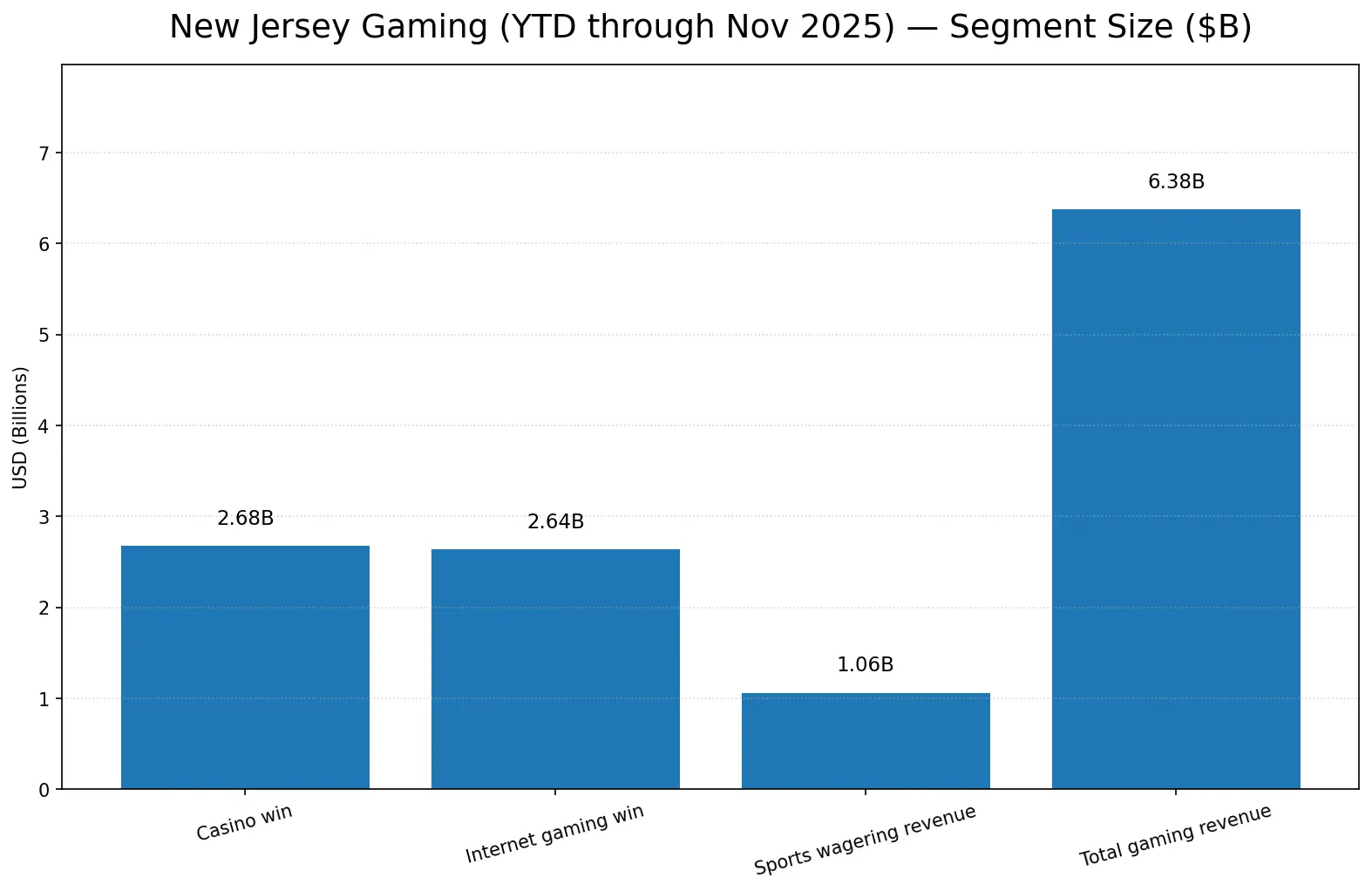

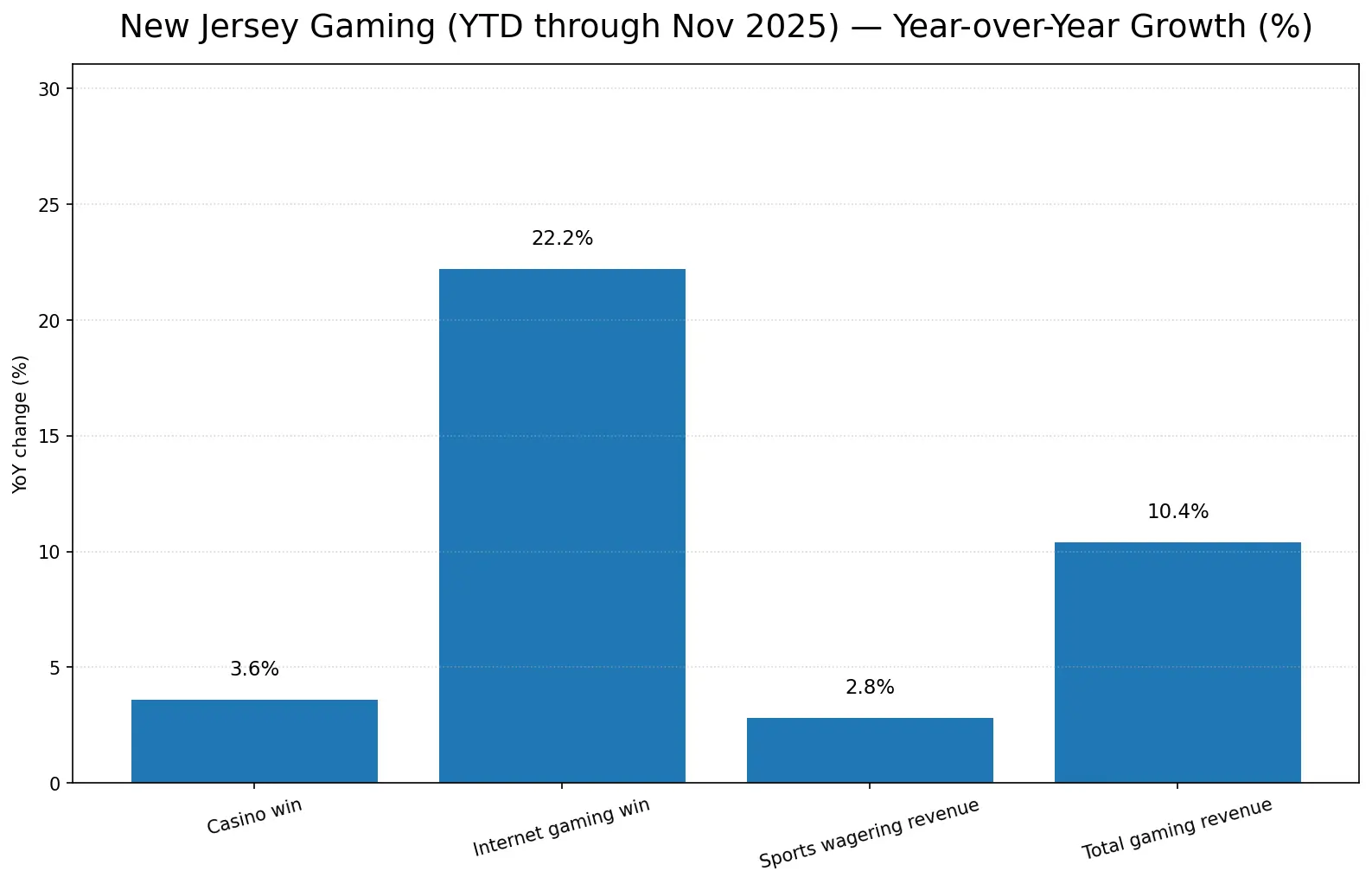

| New Jersey (US) | iGaming win + total gaming revenue | Internet gaming win $2.64B YTD (through Nov) • Total gaming revenue $6.38B YTD | Market maturity favors content that ranks, retains, and stays compliant. |

| Ontario (CA) | Wagers + revenue + product mix | Nov cash wagers C$9.33B • NAGGR C$406M • Active accounts ~1.30M | Scale is huge; therefore, trust + payments UX directly impact FTD rate. |

| UK (operator data) | Slots behaviour + GGY | Slots GGY £747M (+9% YoY) • Sessions >1h down 15% | Behaviour changes mean you must update copy (limits, RG tools, expectations). |

Affiliate Year in Review 2025: the market data that mattered

This section is intentionally affiliate-focused. Instead of listing numbers only, we connect them to content strategy, funnel UX, and commission economics.

2.1 New Jersey: iGaming stayed the growth engine (YTD through Nov 2025)

New Jersey remains one of the clearest regulated-market signals. According to the official November 2025 release, internet gaming win reached $2.638B YTD (through November), while total gaming revenue hit $6.377B YTD. In addition, the same release notes a mid-year tax change: effective July 1, 2025, internet gaming and online sports wagering were taxed at 19.75%. Source (official PDF): NJ DGE / NJOAG — Nov 2025 Gross Revenue Press Release.

What it means for affiliates

- However, higher tax and compliance costs can tighten operator margins, so low-quality traffic gets penalized faster.

- As a result, clarity on terms (wagering, payouts, KYC) becomes part of conversion, not “nice-to-have copy.”

- Moreover, outbound links to regulators and visible RG blocks reduce edits and improve trust signals.

2.2 Ontario: massive monthly volume + casino-led mix (through Nov 2025)

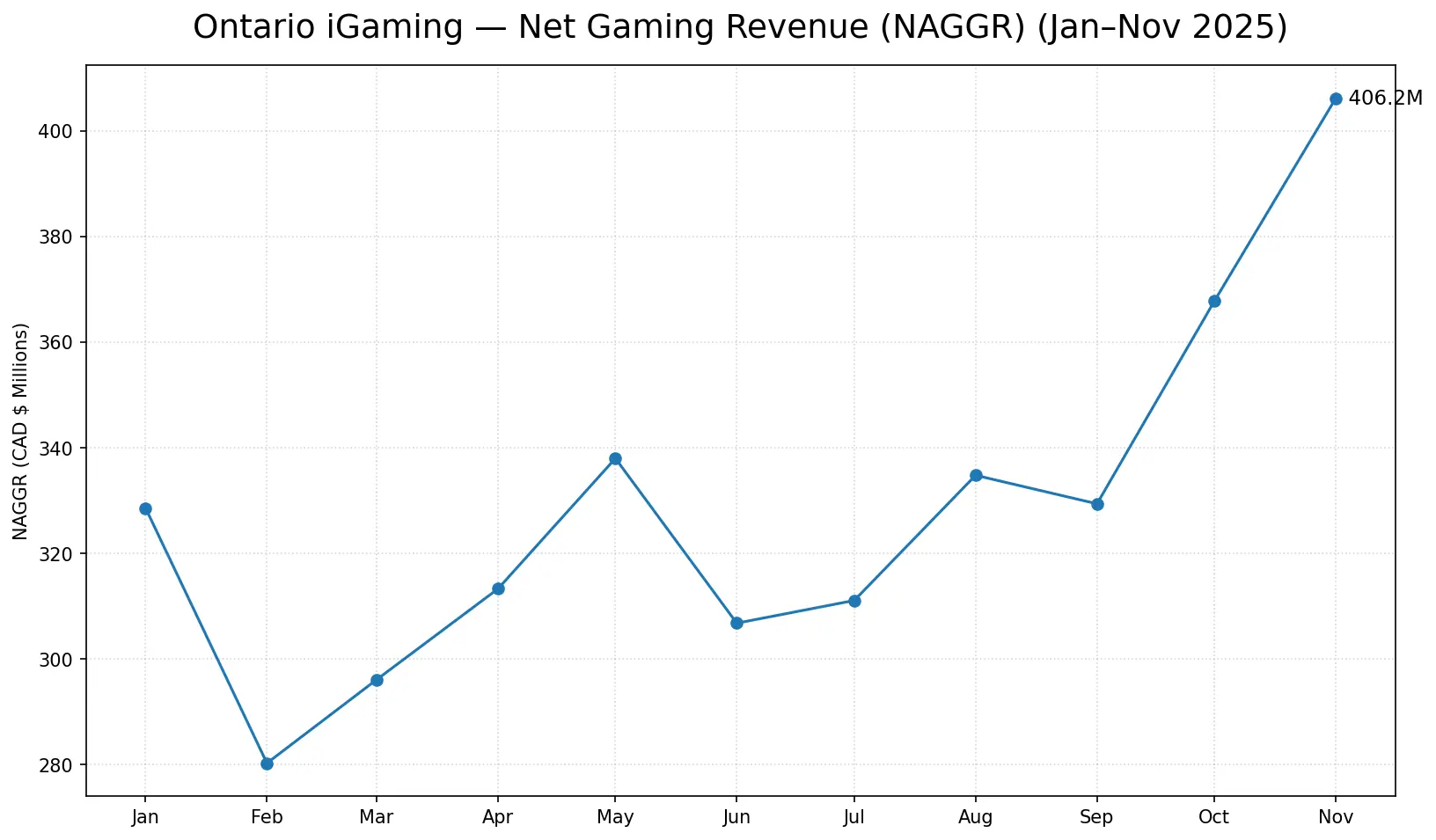

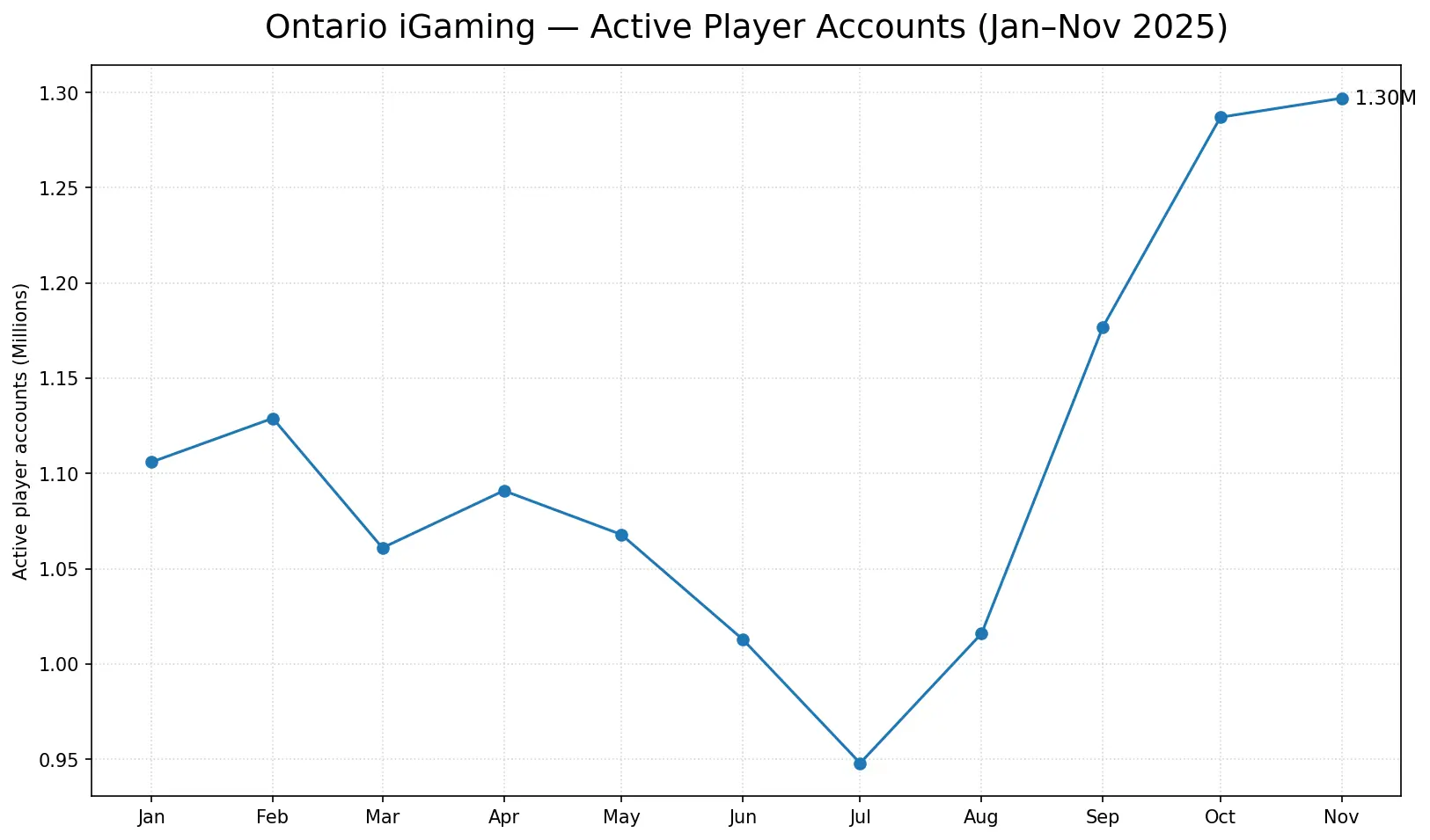

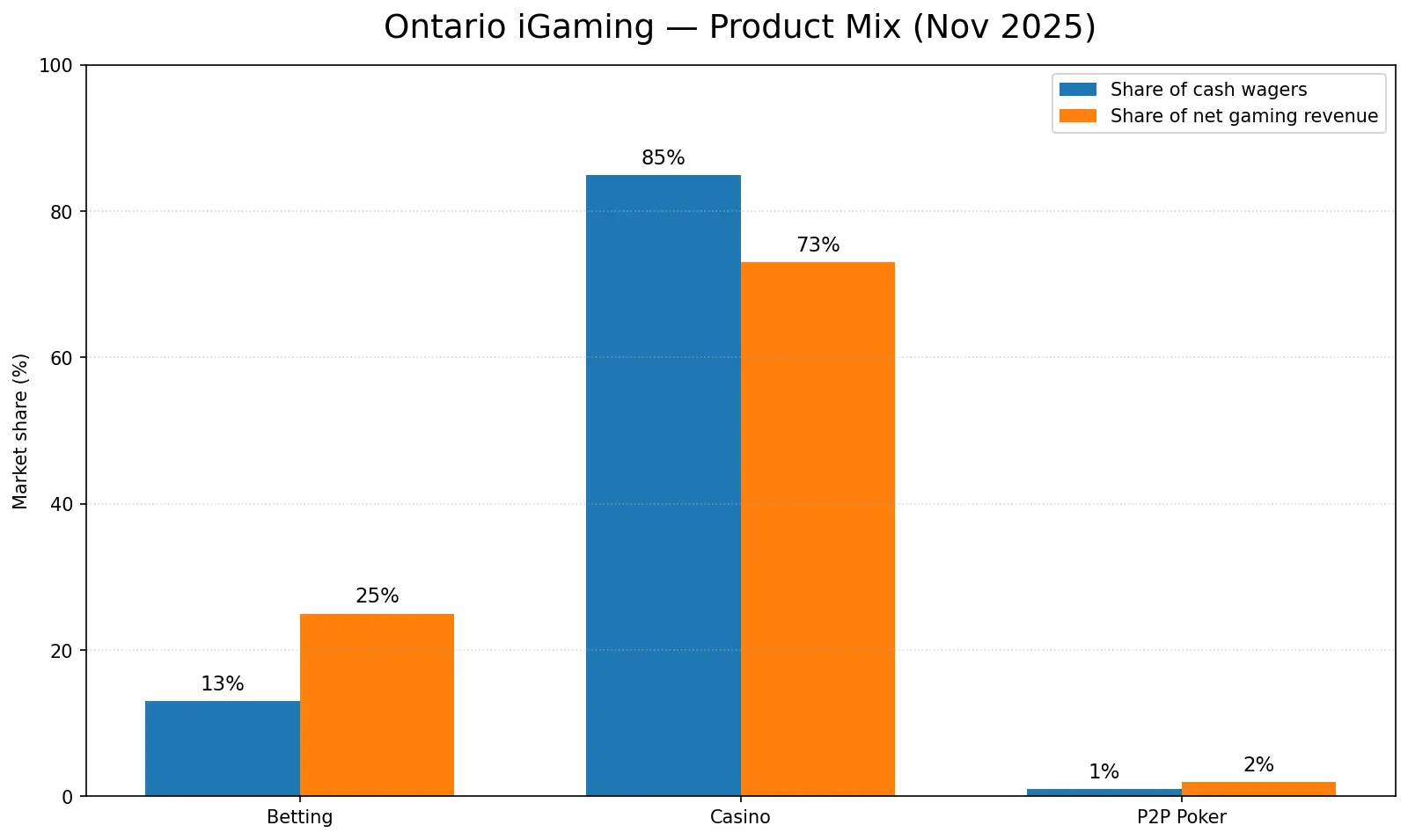

Ontario’s iGaming Ontario publishes monthly performance tables. We reference the latest set available at time of writing (including Nov 2025). Official page: iGaming Ontario — Monthly Market Performance.

- Nov 2025 cash wagers: C$9.33B

- Nov 2025 net gaming revenue (NAGGR): C$406M

- Nov 2025 active player accounts: ~1.30M (accounts, not unique people)

- Jan–Nov 2025 totals (sum of monthly tables): cash wagers ~C$88.9B • NAGGR ~C$3.61B

What it means for affiliates

- For example, casino content remains the volume engine, while betting pages can outperform on revenue per user.

- Therefore, build both: casino hubs for scale and sports hubs for event-driven spikes.

- In addition, local trust blocks (payout expectations + KYC basics) improve conversion without aggressive copy.

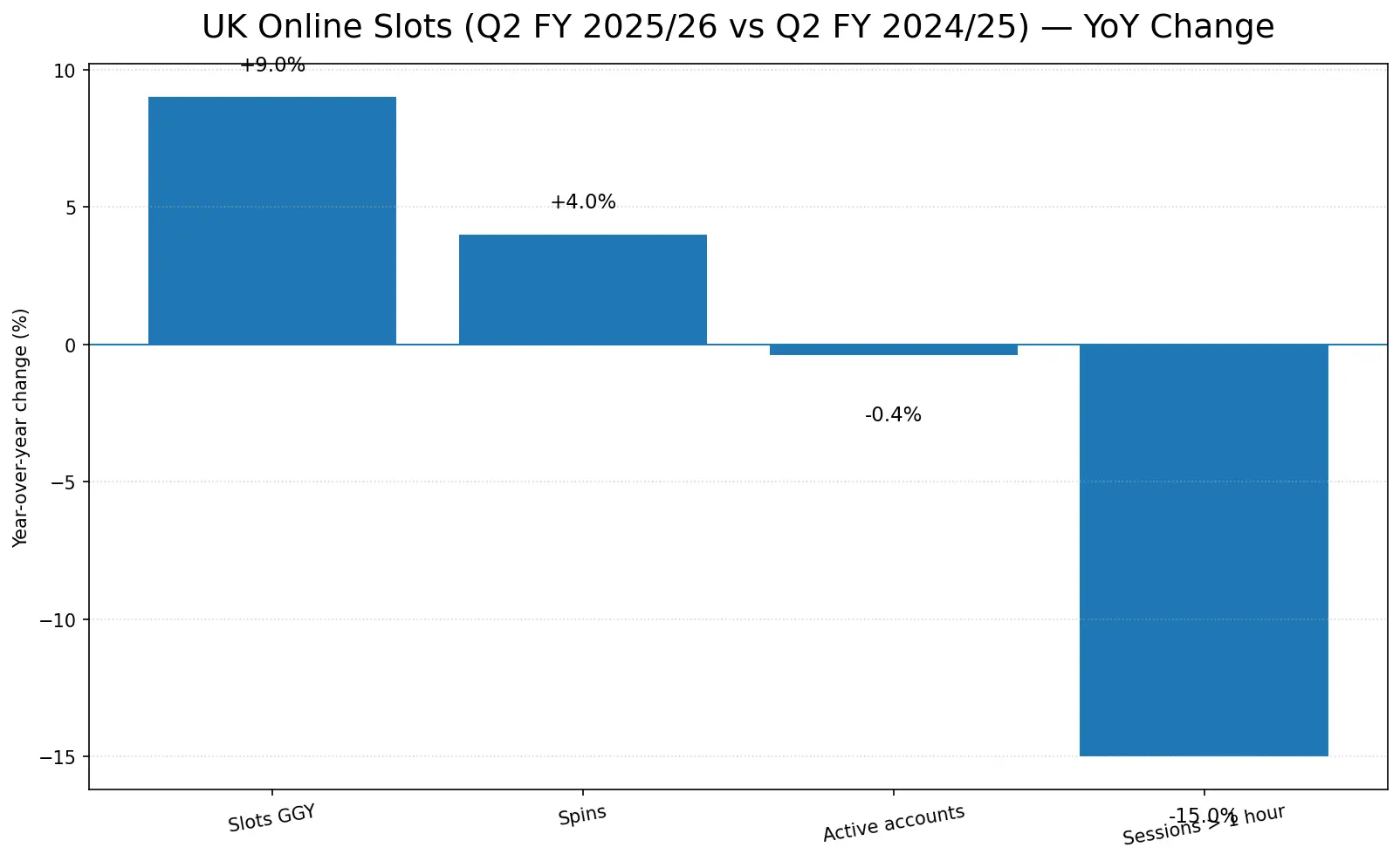

2.3 UK: slots stake limits + behaviour shifts (operator data to Sep 2025)

The UK Gambling Commission publishes regular operator data, which helps affiliates understand behavioural shifts. In the update covering operator data to Sept 2025, the UKGC highlights slot GGY growth alongside a decline in sessions longer than one hour, and it references the introduction of online slots stake limits in 2025. Official source: UKGC — Market impact data (to Sept 2025).

What it means for affiliates

- Consequently, UK-facing pages should reflect stake-limit reality and safer-play tools.

- At the same time, compliant language protects distribution with partners and platforms.

- In contrast, outdated “high-stakes” messaging can trigger friction and lower trust.

Affiliate Year in Review 2025: tracking & analytics (what worked)

In 2025, tracking stopped being a backend detail. Instead, attribution became a direct revenue driver. That’s why teams who treated analytics like product kept more commissions and scaled with fewer disputes.

3.1 The 2025 attribution stack (minimum viable)

- First, standardize UTMs across Shorts/Reels/Email/SEO with one naming sheet.

- Next, use server-side postbacks where available, especially for mobile-heavy funnels.

- Then, keep GA4 events clean: dedupe conversions and avoid inflated “purchase-like” signals.

- Finally, reduce redirect chains because speed is also tracking insurance.

For a full technical playbook, use: Server‑Side Tracking for iOS 17. Also, for KPI baselines (EPC, FTD rate, churn windows), see: Affiliate Marketing in iGaming: KPIs & Pitfalls.

3.2 A simple 7‑day tracking training sprint

- Day 1: define UTM taxonomy and channel names.

- Day 2: lock GA4 conversion definitions (signup vs FTD proxy vs click-out).

- Day 3: audit landing pages (speed, trust block, compliance text).

- Day 4: map postbacks (network → tracker → analytics) and verify dedupe.

- Day 5: run one A/B test on CTA + one “KYC expectations” paragraph.

- Day 6: build a retention capture (email or Telegram sequence).

- Day 7: ship a dashboard with 6 KPIs only (clicks, CTR, signup, FTD proxy, EPC, clawback flags).

If email is part of your stack, add: Email Deliverability for Affiliates 2025.

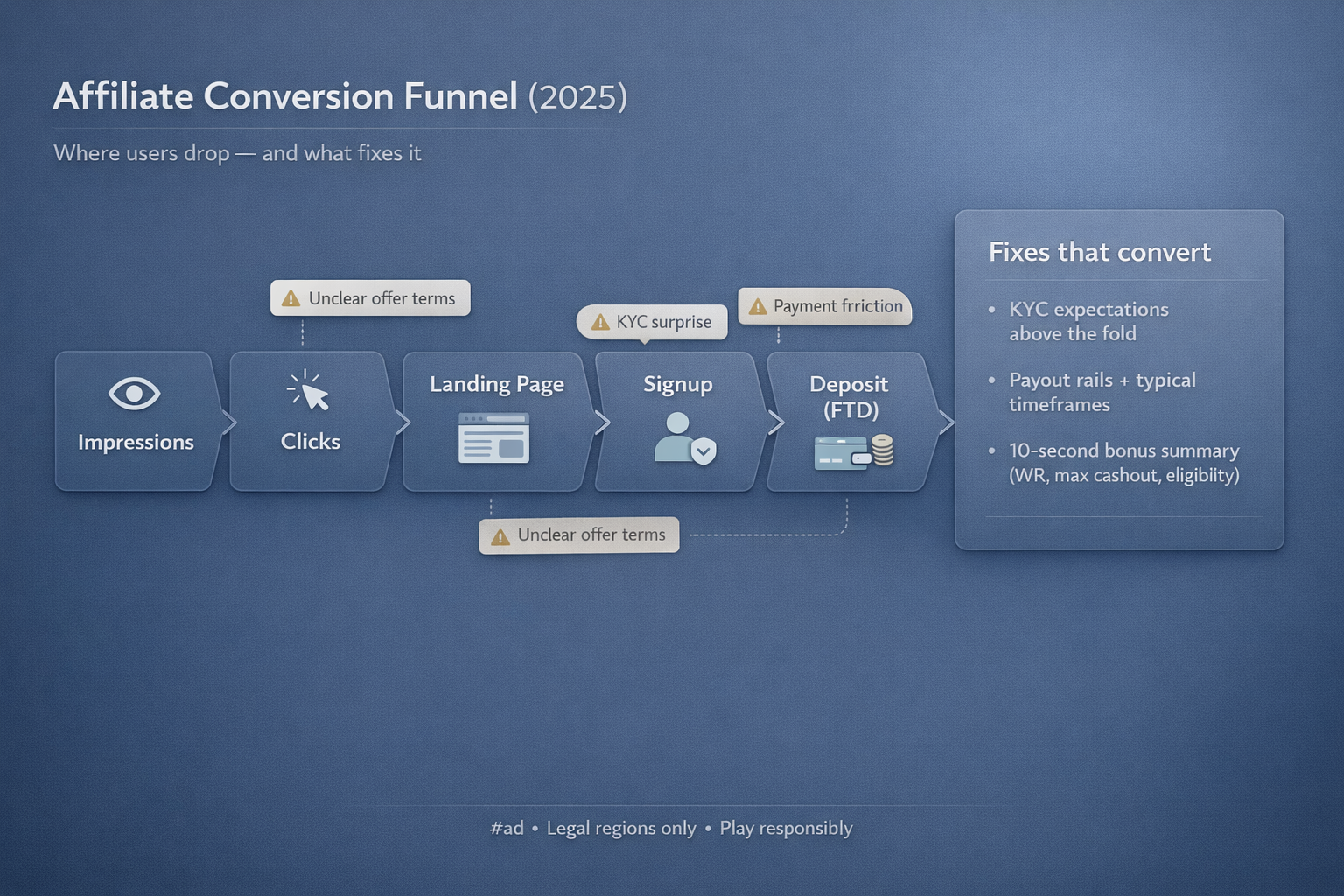

2025 conversion lessons: KYC, payments, and offer clarity

Conversion in 2025 wasn’t only about the CTA button. Rather, it was about what happens after the click: verification steps, deposit rails, payout expectations, and whether bonus terms are understandable in 10 seconds.

4.1 The “KYC expectations” paragraph that reduces drop-offs

Use a short block near the top of high-intent pages. For example, place it under the bonus summary or the first CTA.

- What you’ll be asked for: ID + proof of address (common).

- When it happens: often before first withdrawal; sometimes before deposit.

- How long it takes: it varies, so avoid “instant approval” claims.

- Why it exists: AML, fraud prevention, and age verification.

4.2 Payments: payout speed became a content angle

A payment section that lists withdrawal rails, typical windows, and common holds can outperform generic “bonus code” copy. Moreover, it builds trust early. See: Crypto Casino Payout Speeds 2025.

4.3 Offer clarity: treat “10-second comprehension” as a KPI

- First, put wagering requirement and max cashout in the first screen.

- Second, explain eligible games (casino) or markets (sports) in one sentence.

- Third, show geo restrictions early so users don’t waste time.

2025 content spikes: hubs that converted during peak weeks

The highest-performing format in late 2025 was “Hub + Subpages.” In short, one index page ranks, while multiple short match pages convert.

5.1 Late‑2025 hubs we published (internal links)

- NFL Week 18 Betting 2025: Schedule & What’s at Stake

- Christmas 2025 Betting – NFL on Netflix, NBA Christmas, Boxing Day Shift

- November–December 2025 Betting Events – Worlds Final & CFP First‑Round

- October 2025 betting news – NCAA, Halo & LoL Worlds

5.2 Scheduling rule that worked in 2025

Publish hubs 10–14 days before the spike. Then, publish match subpages 48–72 hours before kickoff. As a result, you get indexation early and conversions late.

| Post type | When to publish | What it includes |

|---|---|---|

| Event hub (index) | T‑14 to T‑10 | Schedule, how-to-watch links, safe-play block, internal links |

| Match subpages | T‑3 to T‑2 | Props primer, live-bet script, lineup/news placeholders |

| Day-of update | T‑0 | Injuries, weather, odds movement (no hype, just clarity) |

For seasonality context, see: December iGaming Profit: Holiday Impact & 2025 Outlook.

What we learned from ranking affiliate portals in 2025

Aff Rate isn’t only content — it’s a scoring system. In 2025, we doubled down on transparency with a consistent 0–100 framework and explainable weights. Start here: Methodology • Browse: Affiliates Directory.

6.1 The scoring weights (why some portals outrank others)

| Factor | Weight | Fastest way to improve |

|---|---|---|

| Traffic & Reach | 30% | Ship useful tools, earn mentions, and build real demand (not bots). |

| Reputation & Licensing | 25% | Clarify compliance pages, licensing posture, and trust signals. |

| Bonus Portfolio | 20% | Make offers understandable and avoid vague copy. |

| UX & UI | 15% | Improve speed, mobile layout, and time-to-key-info. |

| Affiliate Support | 10% | Show contacts, transparent payout windows, and docs. |

6.2 A trust block that improved conversions

- First, put disclosure (#ad + partner note) above the fold.

- Next, show GEO eligibility and licensing context in one line.

- Then, add payments + KYC expectations to prevent surprises.

- Finally, keep RG resources visible without endless scrolling.

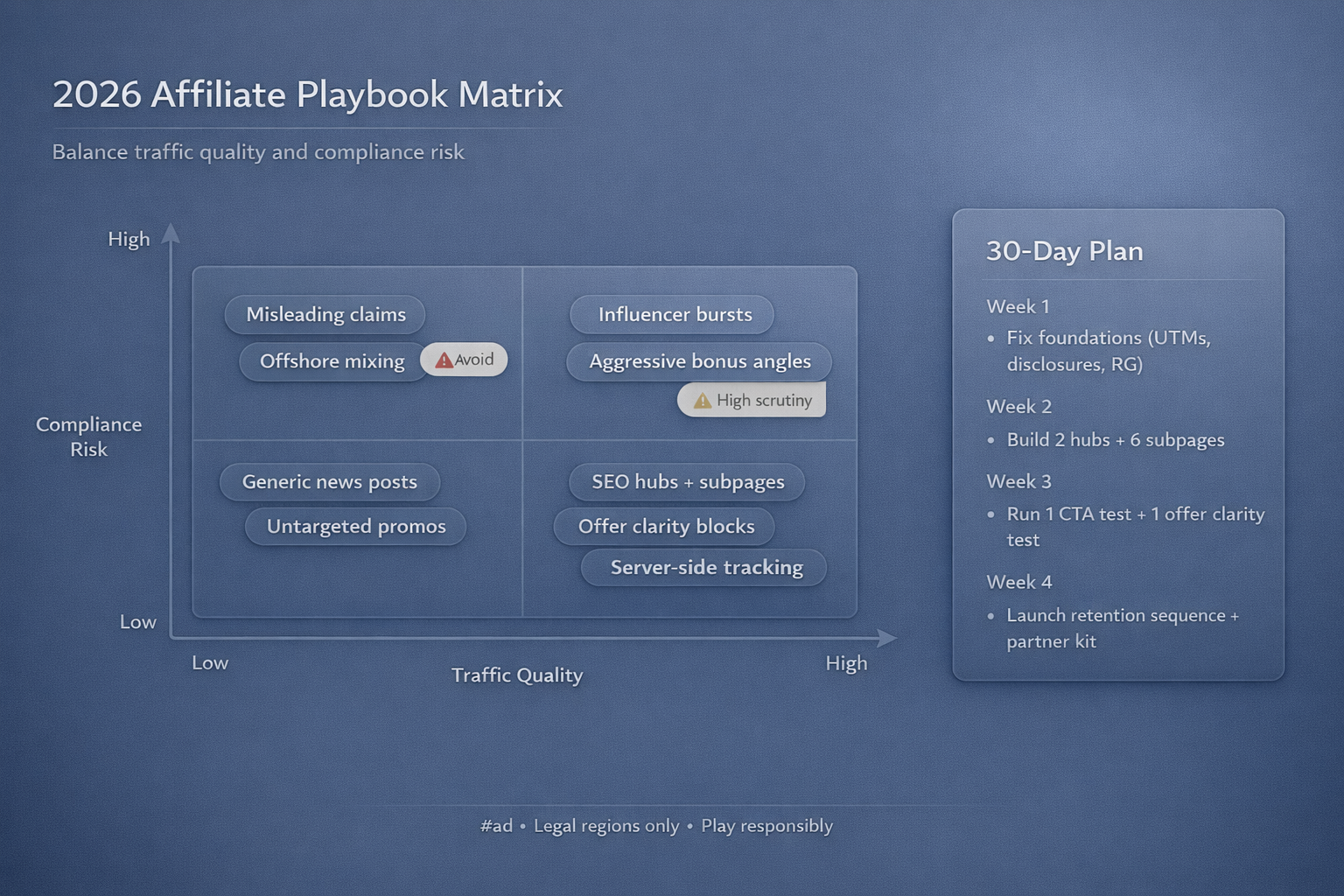

Affiliate Year in Review 2025 → the 2026 playbook (30‑day plan)

The goal for January isn’t “publish more.” Instead, ship a measurable system: a few hubs that rank, conversion upgrades that compound, and an attribution setup you trust.

Week 1: audit & fix foundations

- First, ship a visible disclosure + RG block site-wide.

- Then, standardize UTMs using one source-of-truth sheet.

- Additionally, update top pages with “KYC expectations” + payout rails.

Week 2: build 2 hubs + 6 subpages

- For example, one sports hub (NFL playoffs / UFC / NBA marquee).

- In parallel, one evergreen hub (tracking, commission models, or KYC).

- As a result, you get both seasonal spikes and stable long-tail demand.

Week 3: conversion experiments

- Start with one CTA variant test (verb + placement) on two pages.

- After that, add a “10-second offer summary” above the fold.

- Finally, instrument one clean GA4 conversion and dedupe events.

Week 4: retention & partner relationships

- Meanwhile, launch one email or Telegram sequence for new users.

- Also, create a partner kit page (sources, compliance posture, reporting cadence).

- Optionally, invite partners via Submit Your Site.

Affiliate Year in Review 2025 FAQ

Was 2025 a good year to be an iGaming affiliate?

For teams with clean tracking, strong compliance, and useful hubs: yes. However, thin content and messy attribution struggled more than ever.

What’s the #1 conversion fix that doesn’t require dev work?

Add a visible “KYC expectations + payout rails” block near the top of high-intent pages. As a result, fewer users drop before first deposit.

What should affiliates prioritize for 2026?

Prioritize attribution stability, compliance that reduces edits, and hub architectures that capture peak demand with subpages. In short, build systems that compound.

Related guides on Aff Rate

- Affiliate Profit Analysis 2025 — EPC math, traffic stacks, scaling risk.

- Rev‑Share vs CPA vs Hybrid 2026 — choosing commission models under tighter tracking.

- Server‑Side Tracking for iOS 17 — postbacks, GA4, mobile attribution.

- Crypto Casino Payout Speeds 2025 — payout rails as a conversion lever.

- Methodology — our 0–100 scoring and weights.

Sources (verified Dec 30, 2025)

- New Jersey DGE / NJOAG — November 2025 gross revenue press release (YTD totals + tax note): PDF

- iGaming Ontario — Monthly Market Performance (tables through Nov 2025): Official page

- UK Gambling Commission — Market impact data on gambling behaviour (operator data to Sept 2025): Official update

- Responsible gambling resources: NCPG (US) • BeGambleAware (UK) • GamCare (UK)