The debate over rev‑share vs CPA vs hybrid 2026 is more than a pay‑plan preference—it’s a strategic choice about cash flow, risk, and long‑term alignment with advertisers. In mature markets (UK/EU/IN), operators lean toward revenue share (rev‑share), tying higher rates to quality and churn KPIs; in high‑growth markets (US/LATAM), CPA still drives expansion but with post‑verification triggers and clawbacks. Hybrid is surging back, combining up‑front CPA with ongoing revenue share once a customer proves value. Networks now offer dynamic commissioning and smart‑match tools that tailor rates by campaign, product margin, or traffic quality.

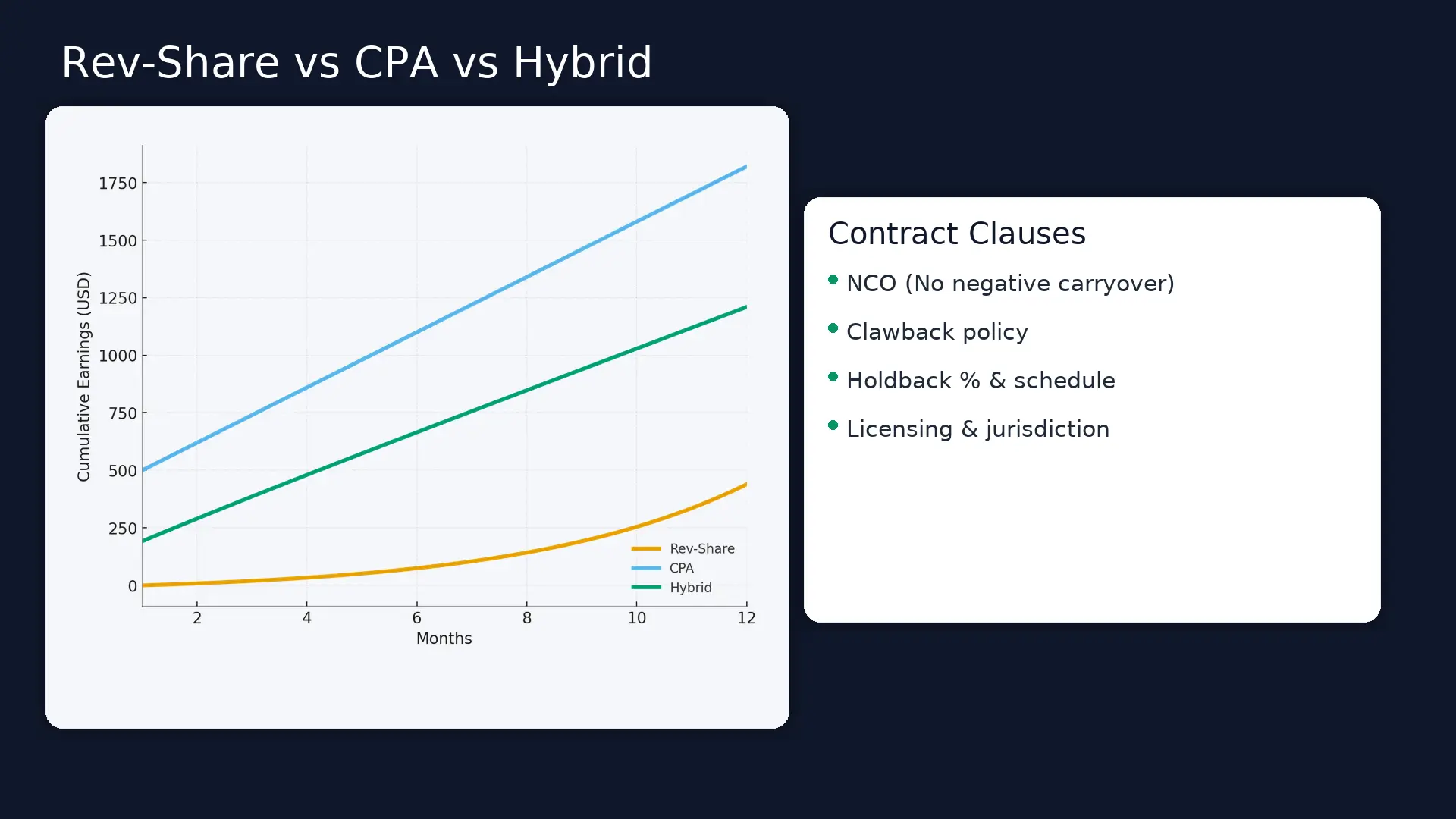

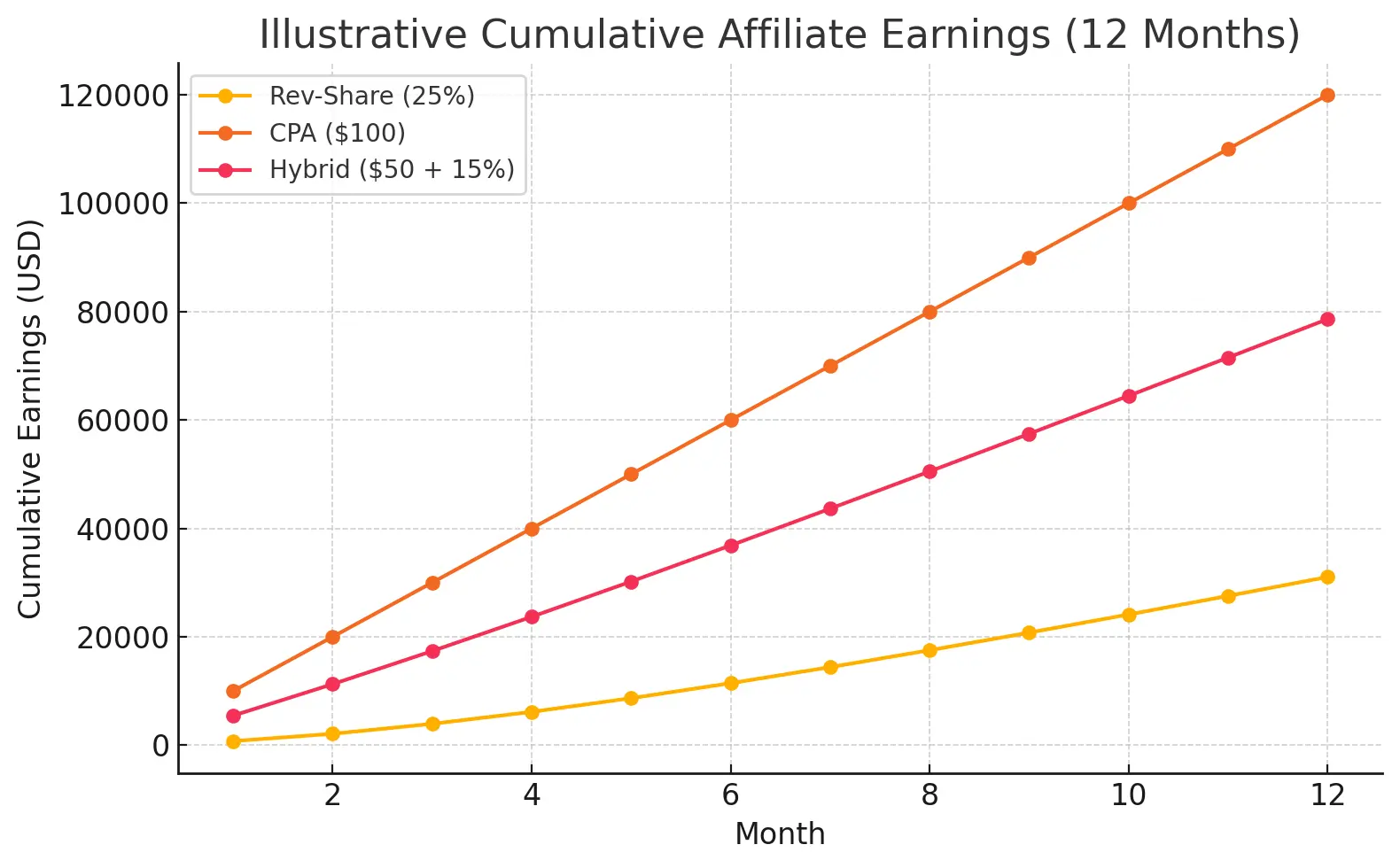

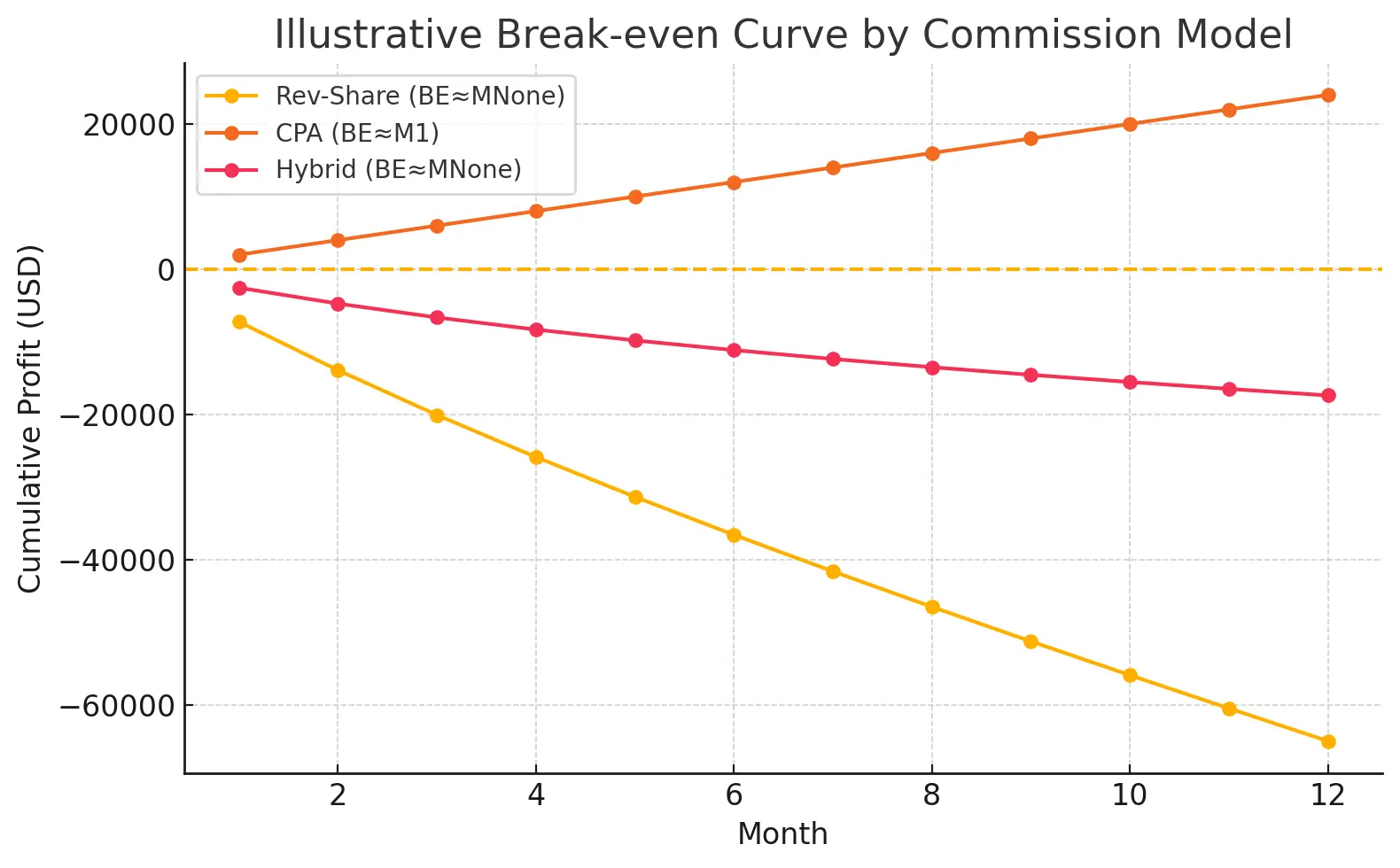

This guide defines each model, lists practical pros/cons, flags the contract clauses that really matter (negative carryover, holdbacks, minimum activity, clawbacks), and compares regional rules (e.g., Massachusetts restrictions on revenue-share; Pennsylvania’s separate licensing paths for CPA vs rev‑share). You’ll also find **two charts** modeling cash‑flow behavior, plus a **decision framework** to pick the best structure for 2026—and renegotiate with data on your side.

1. Rev‑Share vs CPA vs Hybrid 2026 — Quick Definitions

- Revenue Share (Rev‑Share): Ongoing % of net or gross revenue per referred customer (common iGaming/fintech: ~10–45%, sometimes higher on promotional tiers). SaaS often uses recurring % of subscription.

- CPA (Cost‑Per‑Acquisition): One‑off bounty paid after a qualified action (e.g., deposit + KYC). Sportsbook CPAs commonly cited around $50–$200, varying by geo and license costs.

- Hybrid: Smaller CPA + trailing rev‑share (e.g., $50 CPA + 15%). Used to balance short‑term cash with lifetime upside; increasingly tailored by product and geography.

Major networks and platforms (Awin, CJ, impact.com, Rakuten) support mixed commissioning, dynamic tiers, and campaign‑level rules—making “hybridization” easier than in past years.

2. Rev‑Share Model: How It Works (and When It Wins)

Rev‑share pays a percentage of advertiser revenue generated by your referrals. In casino/sports betting, tiered rev‑share is common (e.g., 20% → 35–50% at higher deposit/wager tiers). In B2B SaaS, recurring % on subscriptions aligns with longer sales cycles and retention.

2.1 Pros & Cons of Rev‑Share

- Upside with LTV: Compounds when product retention is strong (e.g., casino VIPs; sticky SaaS).

- Aligned incentives: You and the operator both care about quality, not just volume.

- Slower payback: Cash comes as users spend over time; not ideal if you must fund paid media weekly.

- Exposure to operator margins: Aggressive bonuses, low hold, or high churn lower your take.

2.2 Clauses to Watch in Rev‑Share

- Negative carryover (NCO): If player winnings exceed losses, the negative NGR can roll to the next month. Negotiate “no negative carryover” or a cap.

- Quota/Minimum Activity: Some programs drop tiers if you don’t deliver X NDPs / month.

- Holdbacks: A % of commission withheld for fraud/chargebacks—ask about timelines and thresholds.

3. CPA Model: How It Works (and When It Wins)

CPA pays once, triggered by a verified action: deposit + KYC, a qualified purchase, or milestones (first three bets, ARPU threshold). In regulated iGaming, $50–$200 per player is commonly advertised, but real rates vary with license cost, state taxes, and competitive intensity. Programs often incorporate delayed CPA or split milestones (e.g., $75 on deposit, $75 after activity), plus clawbacks if the user churns or fails compliance within 30–60 days.

3.1 Pros & Cons of CPA

- Immediate cash flow: Useful for paid‑media arbitrage and fast scaling.

- Predictable CAC for advertisers: Easy to model per state/geo.

- Volume bias: Can encourage low‑quality signups if not guarded by verifications.

- No LTV upside: A whale you referred later generates $0 to you—unless your deal includes tail payouts.

3.2 Clawbacks & Post‑Verification Triggers

“Clawback” means reversing a previously paid commission if transactions are invalid, refunded, or fail KYC/wagering requirements; it’s standard across many affiliate agreements. Read the clawback and verification schedule carefully and test with small volume first.

4. Rev‑Share vs CPA vs Hybrid 2026 — Hybrid Models Explained

Hybrid blends an up‑front CPA with a smaller ongoing share (e.g., $50 CPA + 15%). Networks recommend hybrids to balance advertiser risk with affiliate upside; case studies show brands using hybrid creator/affiliate mixes for material ROI. impact.com documents multiple hybrid structures and a creator program reporting 12% of total sales at 982% ROI via a hybrid approach—proof that “both” can win when tracking and margins support it.

4.1 Hybrid Trends to Watch in 2026

- Threshold‑based tails: Rev‑share activates only after customer spend/deposit thresholds—protects advertisers while rewarding quality.

- Dynamic commissioning: Tiers change by campaign parameter, margin, or SKU priority (Awin’s Commission Manager).

- Geo‑specific hybrids: Lower CPA + higher tail in high‑churn markets; higher CPA + lower tail in stable LTV markets.

5. Regulation & Licenses: Your Model May Be Dictated by Law

US states can treat affiliate compensation models differently. Massachusetts (2023) temporarily allowed CPA and revenue‑share via waiver, then proceeded with rules that—per trade coverage—tightly limit revenue‑share while permitting CPA arrangements. Always confirm the **current** MGC position before structuring deals. In Pennsylvania, affiliates face separate licensing tracks for CPA vs rev‑share. Several states require licensing for media affiliates (e.g., AZ, CO, IN, NJ, PA), with different disclosures and background checks.

In the UK/EU, general consumer‑protection rules apply plus strict operator KYC and marketing codes; ensure your disclosures comply with the **FTC Endorsement Guides (2023 update)** and local equivalents. Put #ad or “commission earned” clearly within one screen scroll.

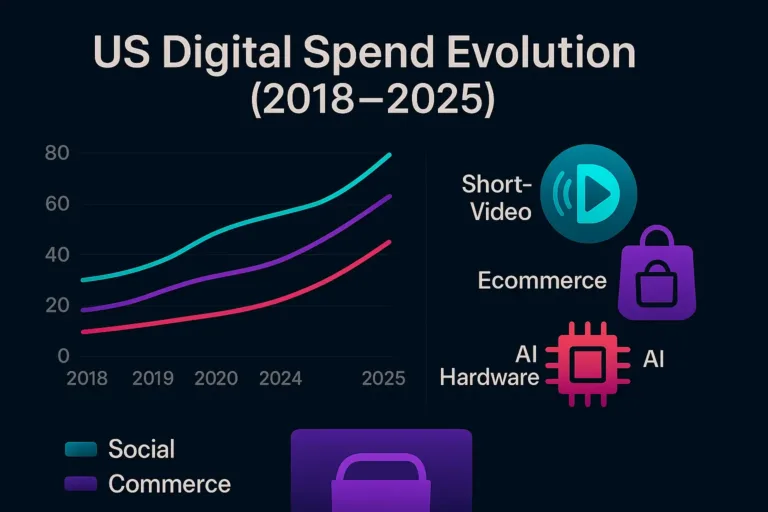

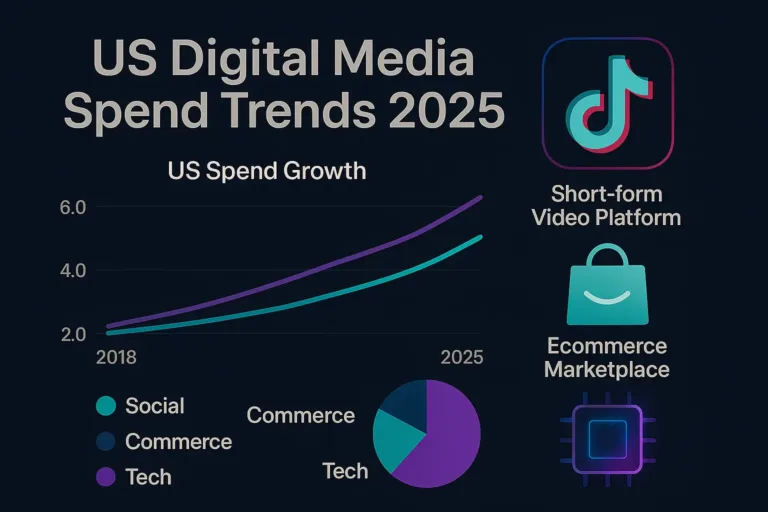

6. Analytics & Tracking: Proving Value Without Cookies

Post‑iOS and privacy changes force a move to server‑side tracking—otherwise you under‑count conversions (and negotiate from weakness). Networks and analytics vendors support S2S/postbacks to recover 9–12% of “lost” conversions; server‑side GTM and Events APIs (Meta/TikTok) restore data reliability.

7. Rev‑Share vs CPA vs Hybrid 2026 — Cash‑Flow Behavior

The following illustrative charts model three commission models over 12 months. Assumptions (for clarity, not a forecast): 100 new customers each month; rev‑share 25% of $30 net revenue per active user with 20% monthly churn; CPA $100 per qualified user; Hybrid $50 CPA + 15% tail. Paid media = $8,000/month. Your real results will vary by LTV, churn, bonus policy, and fraud controls.

In the scenario above, CPA tends to break even earliest (fast cash), Hybrid follows (some tail + partial upfront), and Rev‑Share catches up as retained users compound. This mirrors how advertisers assess payback period vs lifetime value and why hybrids are spreading in mid‑maturity markets. (Illustrative example only.)

8. Read the Contract: Clauses that Change Your P&L

| Clause | What It Means | Why It Matters |

|---|---|---|

| Negative Carryover (NCO) | Negative NGR balances roll into next month if players win more than lose. | Can wipe out next month’s earnings; negotiate no NCO or caps. |

| Clawbacks | Reversal of commissions for invalid/refunded transactions or failed KYC. | Standard in CPA; check time windows (30–60 days) and fraud definitions. |

| Holdback / Reserve | % withheld for chargebacks/fraud, paid later if clean. | Stress‑test cash‑flow if you buy media weekly. |

| Minimum Activity | Tiers revert if you miss NDPs or revenue goals. | Affects effective rate; ask for flexible 90‑day windows. |

| Licensing | Some states require affiliate licensing; PA splits CPA vs Rev‑Share tracks. | Budget time & fees; non‑compliance risks non‑payment. |

9. Matching Model to Vertical & Market Maturity

- SaaS / Subscriptions: Rev‑share or Hybrid aligns with renewals and expansion ARR.

- iGaming – Mature markets (UK/EU/IN): Rev‑share/Hybrid with quality KPIs and NCO rules common.

- iGaming – High‑growth (US/LATAM): CPA to scale quickly; post‑verification and clawbacks expected.

- Retail/DTC: Hybrid or product‑specific CPA via dynamic commissioning for promos/margins.

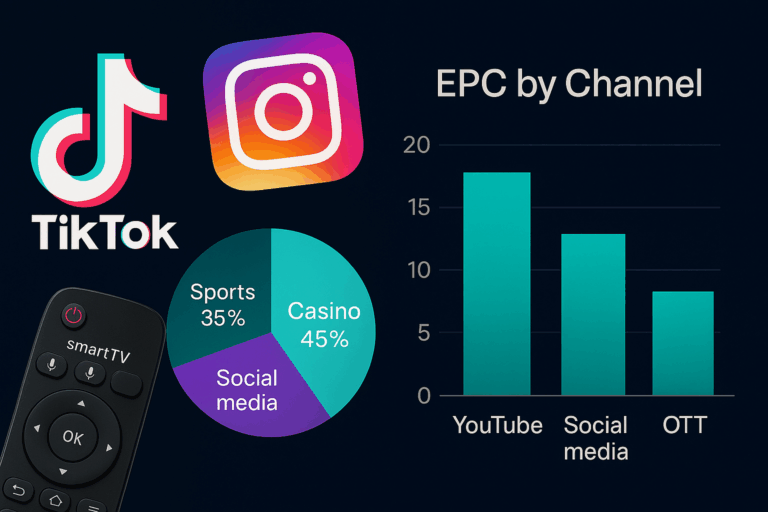

10. Negotiation: How to Get a Better Deal in 2026

- Arrive with data: share EPC, refund rate, traffic geos, and past LTV. Respectable partners reciprocate.

- Ask for a trial hybrid: Start $50 CPA + 15% tail for 60–90 days; review with cohort LTV.

- Target “no NCO” or capped NCO: or at least reset on big‑win anomalies.

- Use campaign‑level commissioning: Different rates for launch promos vs evergreen guides (Awin Commission by Campaign).

- Model true payback: Include holdbacks/clawbacks and bonus costs in your breakeven math.

- Mind licensing: In PA and similar states, choose CPA vs rev‑share track before you apply.

11. Ten‑Step Decision Framework (Copy‑Paste Checklist)

- Estimate realistic LTV by geo/product; stress‑test churn.

- Choose model by cash‑flow need: CPA (fast), Hybrid (balanced), Rev‑Share (max LTV).

- Audit clauses: NCO, clawbacks, holdbacks, minimums.

- Confirm state/country licensing rules; document RG/FTC disclosures.

- Stand up server‑side tracking for clean attribution.

- Use dynamic commissioning for promos & low‑margin SKUs.

- Run A/B contracts: small cohorts on CPA vs Hybrid to compare payback and tail.

- Check partner reputation for timely payout & support.

- Re‑price quarterly on verified LTV/clawback stats.

- Document everything—ticket IDs, rate changes, and tier triggers.

12. Takeaway: Who “Wins” in 2026?

There is no universal winner. CPA “wins” if you need fast payback (or run paid media aggressively). Rev‑Share “wins” when LTV is strong and churn is low. Hybrid “wins” when both sides want speed and long‑tail upside, with thresholds protecting advertiser risk. Treat commission models like an investment portfolio: mix by vertical and market maturity, back it with server‑side data, and renegotiate on cohort LTV—not vibes.

Commission Models 2026: Cash-Flow Curves

Cash-Flow Curves

When Each Wins

CPA:

— quickest payback; scale new geos.

Rev-Share:

— high LTV products; loyal communities.

Hybrid:

— balanced risk; threshold-activated tails.

Info Graphic

Affiliate Contract Checklist 2026

Read before you sign

📉

Negative carryover

Is it capped? Reset policy?

↩️

Clawback window

30/60 days? Fraud definitions?

⏳

Holdback %

When is it released?

📈

Minimum activity

NDPs per month?

📜

Licensing

CPA vs Rev-Share track in state?

🔗

Tracking

Server-side postbacks live?

💎

Promo tiers

Dynamic commission by campaign?

✅

Compliance

FTC #ad, RG labels, geo-fencing.

Sources

- Awin – dynamic commissioning, CPA baseline and tools.

- impact.com – commission structures & hybrid guidance; OLIPOP hybrid ROI.

- Rakuten Advertising – affiliate channel adoption & CPA case (Cotton On).

- CJ – publisher models webinar.

- StatsDrone – sportsbook CPA ranges; individual program examples (35–50% rev‑share).

- PartnerStack – SaaS rev‑share rationale.

- FTC – Endorsement Guides (2023 update) + Q&A.

- Regulatory – Massachusetts restrictions & waivers; PA licensing split; affiliate licensing overviews.

- Clawbacks / NCO – definitions and operator KB examples.