December iGaming profit consistently runs above trend because three forces peak together: (1) more audience availability (holiday downtime and gifting season), (2) unusually dense sports inventory (NBA Christmas, NFL Weeks 16–18, college bowls, Boxing Day racing/football), and (3) broader regulated access. From 2022–2024, regulators in New Jersey and Pennsylvania set new online‑casino highs in December, while the UK’s Oct–Dec quarter delivered record online GGY, sessions and session length—setting the stage for a robust December 2025 with some UK calendar quirks to note.

1) December iGaming profit — what the 2022–2024 data already show

1.1 New Jersey: back‑to‑back December records

The NJ regulator reported Internet Gaming Win of $228.0M in December 2024, up 26.5% YoY from $180.3M in December 2023; total gaming revenue hit $522.6M for the month. This December spike capped a full‑year jump in internet gaming to $2.39B (+24.1% YoY).

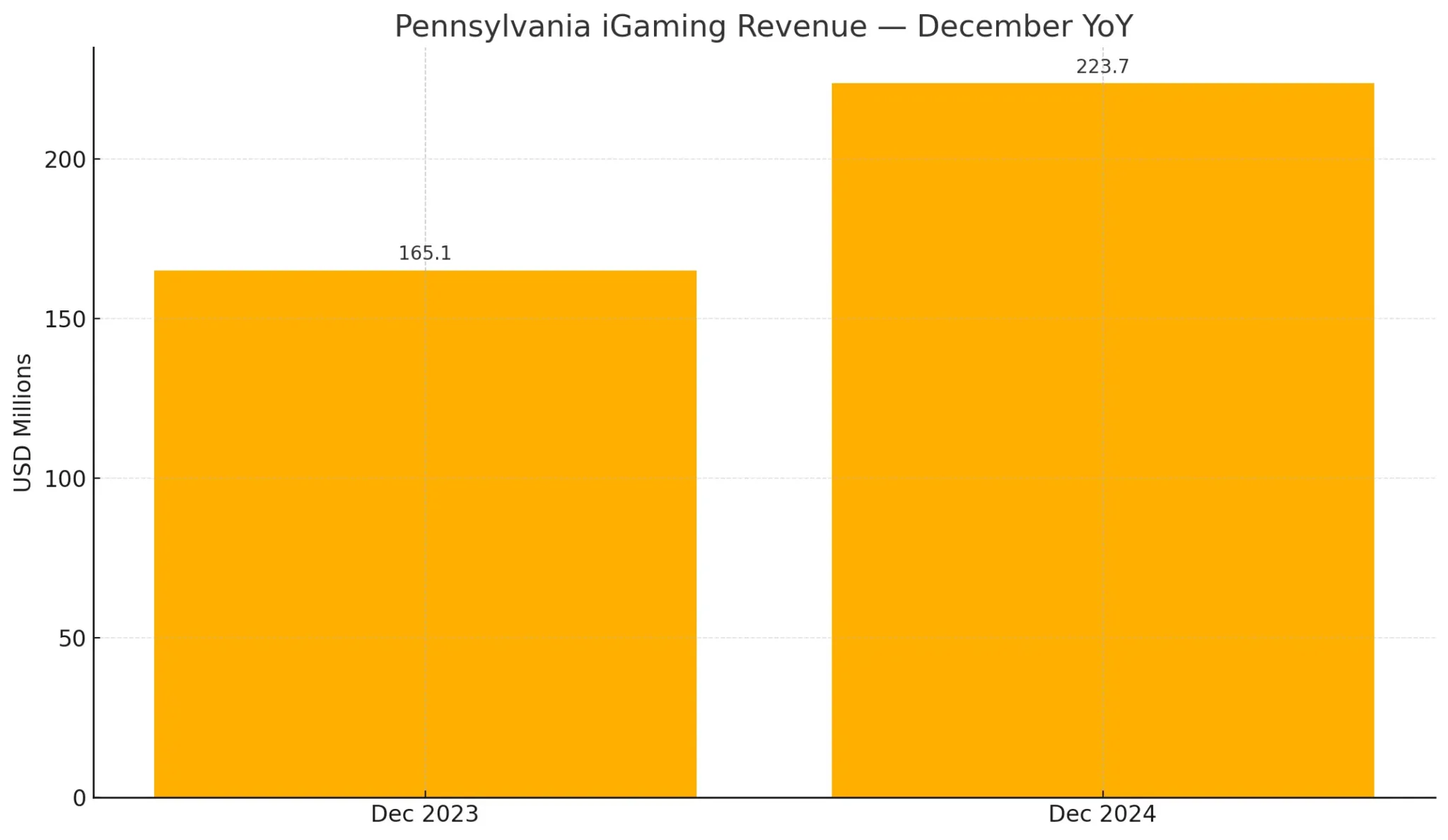

1.2 Pennsylvania: all‑time monthly record in December 2024

The PGCB logged a statewide iGaming record of $223.65M in December 2024 (prior high was November 2024 at $200.49M), versus about $165.1M in December 2023 (sum of slots, tables, poker).

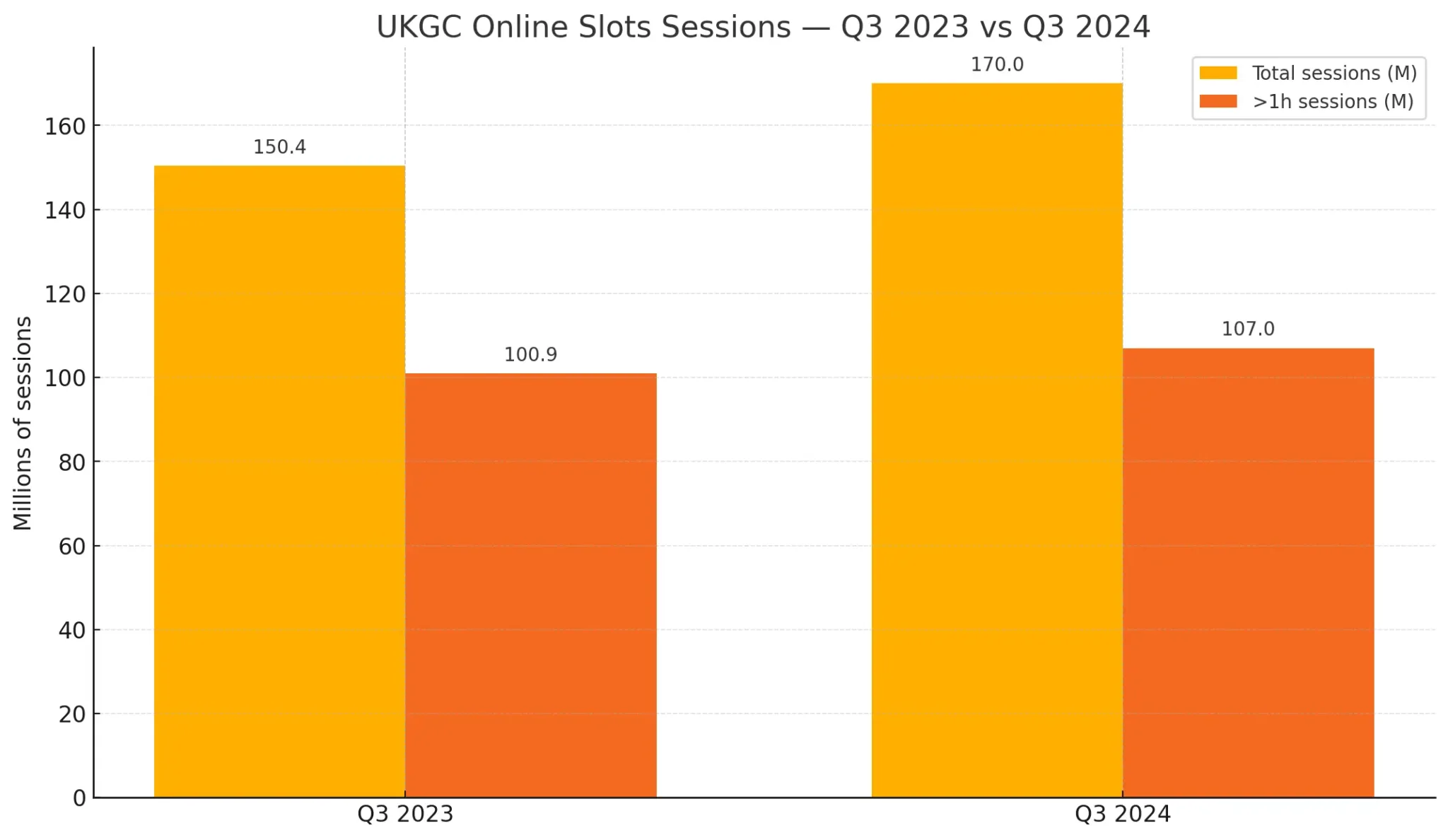

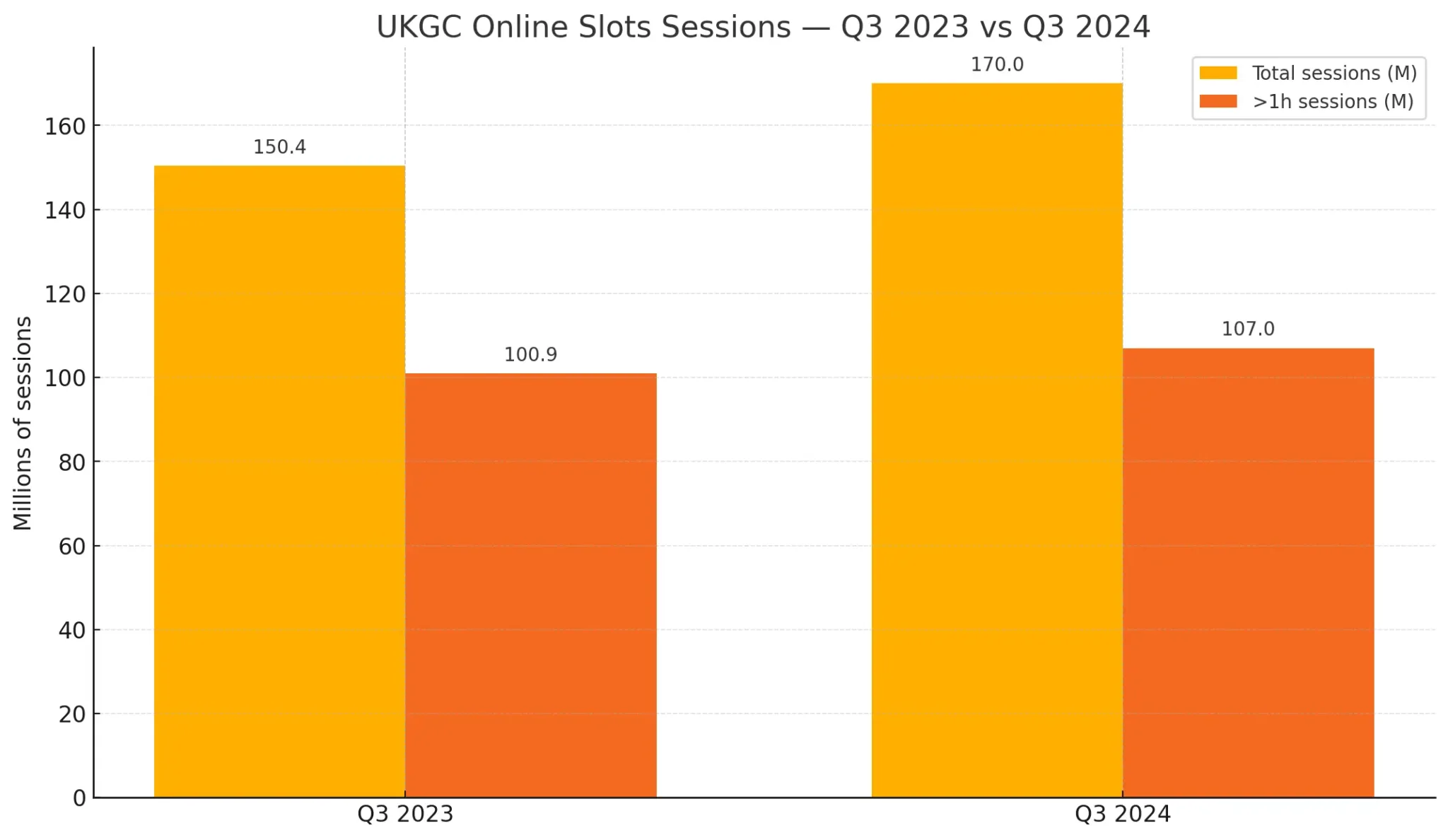

1.3 United Kingdom: Oct–Dec (“Q3”) online surge

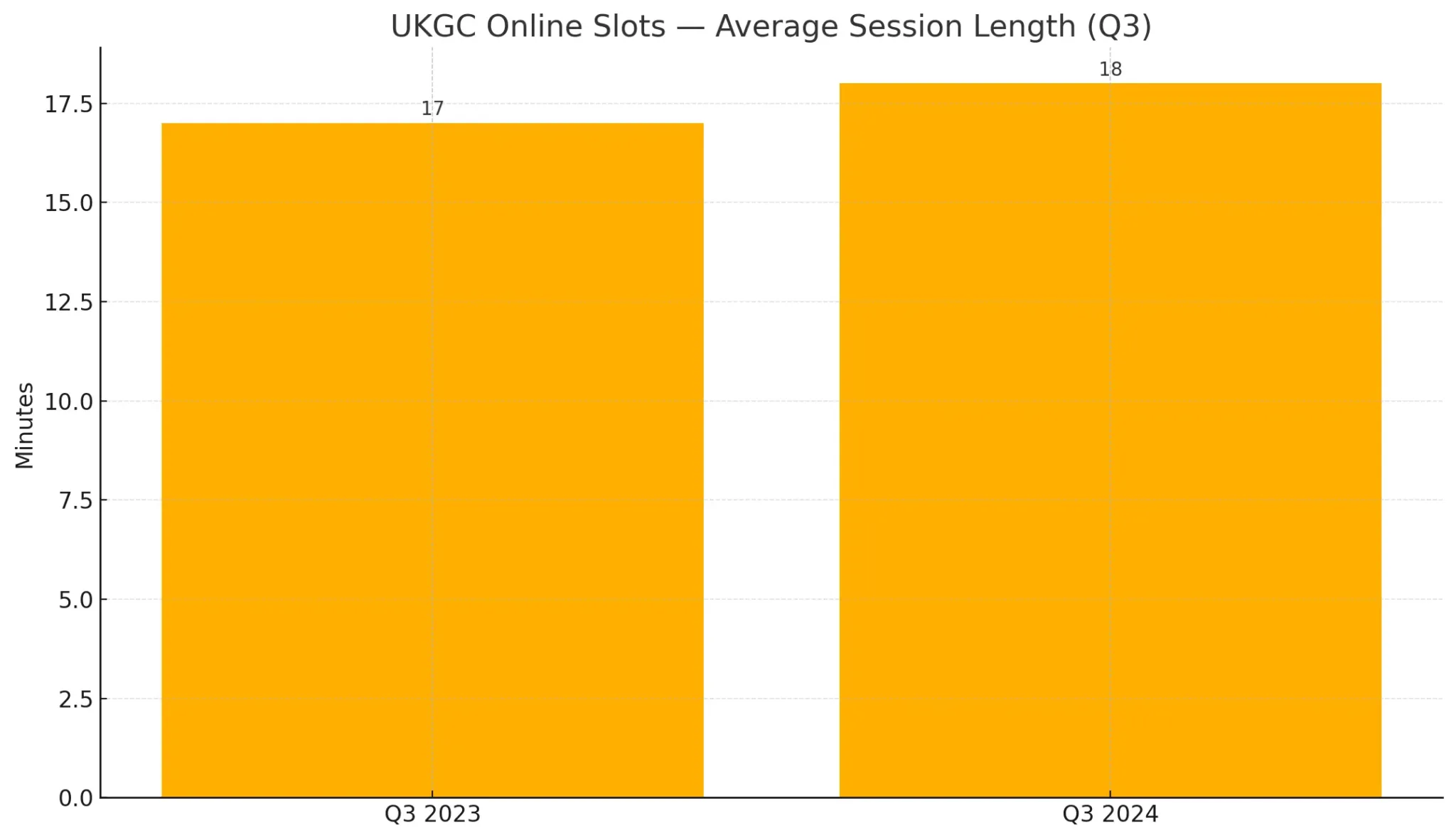

The UK Gambling Commission’s operator dataset through December 2024 shows online GGY of £1.54B in Oct–Dec, up 21% YoY, driven by real‑event betting (+38% YoY). Total online bets/spins set a new peak of 25.9B, total sessions reached 170M (+13% YoY), and average slot‑session length edged up to 18 minutes; ~6% of sessions exceeded an hour.

1.4 Ontario (Canada): holiday‑quarter momentum

Ontario’s regulated market reported C$825.8M in total gaming revenue for Q3 FY2024/25 (Oct–Dec 2024), +25% YoY and +12% vs Q2, alongside strong wagering totals; see iGO’s quarterly report and trade press summaries.

2) Why holidays amplify December iGaming profit

2.1 Sports inventory that converts to handle

- NBA Christmas: 2024 delivered the league’s most‑watched Christmas in five years—5.25M average viewers across five games, up ~84% YoY; the Lakers–Warriors prime‑time game drew 7.76M. Live audiences translate into live bets, SGPs, and micro markets.

- NFL Weeks 16–18 & Bowls: late‑December slates create long, contiguous betting windows (pregame, in‑game, half‑time props)—especially on days without heavy competing events.

- UK Boxing Day (2025 quirk): the Premier League will host only one match on Dec 26, 2025 (Man United vs Newcastle), shifting most fixtures to Dec 27–28. Expect the demand “spike” to spread across two days rather than one.

2.2 Everyone is online—and spends online

Holiday retail is a useful proxy for digital attention. Mastercard SpendingPulse shows online sales +6.7% YoY and total retail +3.8% (Nov 1–Dec 24, 2024). More time online + value‑seeking (promos) = more bonus discovery, longer sessions, and better conversion opportunities for casino and sportsbook operators.

2.3 Regulation expands the addressable base

By mid‑2025, 38 states + DC + Puerto Rico offered legal sports betting in some form; ~30 allowed full online betting—expanding the pool of users who see compliant, geotargeted offers in December.

3) December iGaming profit by region: U.S., U.K. & Canada

3.1 United States — high volume, volatile hold

New York posted about $2.28B in online handle in Dec 2024 (second‑highest month on record), yet statewide hold was just ~6.59% as outcomes skewed toward bettors. Across the 2024 calendar year, NY set fresh highs with ~$22.6B–$23.9B in online handle and >$2B GGR. December is a perfect example of “huge handle, sensitive margin”—great for acquisition/reactivation, but month‑to‑month profit depends on results distribution.

New Jersey & Pennsylvania show the casino side of the holiday effect: December keeps setting online‑casino records (see charts above). Sportsbooks see strong handle; profitability is more path‑dependent (favorite/underdog balance) than in casino.

3.2 United Kingdom & Ireland — Q3 is the online sweet spot

The UKGC’s Oct–Dec (“Q3”) dataset corroborates a clear seasonal lift: online GGY +21% YoY to £1.54B, slots GGY at a high £709M, and a structural rise in session counts and average length. In 2025, the PL’s “one‑game” Boxing Day shifts a portion of search and betting demand to Dec 27–28; affiliates should stage content and promos accordingly, while racing’s King George VI Chase on Boxing Day remains a betting anchor.

3.3 Canada — Ontario’s regulated build‑out

Ontario’s C$825.8M in Q3 FY2024/25 total gaming revenue (+25% YoY) underscores how holiday quarters lift both casino and betting within a regulated framework, supported by expanding product depth and operator count.

4) The human lens: psychology, stress, and safer marketing in December

Holiday seasons boost downtime—but also stress. A GamCare / YouGov study (Dec 2024) found that 59% of people experiencing gambling harms are more likely to gamble at Christmas (vs 37% prior year). Affiliates and operators should surface prominent RG labels, deposit limits, and helplines on holiday pages; the **NCPG “Gift Responsibly”** campaign is an effective seasonal anchor for messaging.

5) December 2025 scenarios — what December iGaming profit could look like

5.1 Casino (baseline and ranges)

If NJ internet gaming grew +26.5% YoY in Dec 2024, a tempered +3% to +10% YoY band for Dec 2025 implies $235–$251M. Pennsylvania’s Dec 2025 iGaming could land in the $240–$260M range if engagement and product breadth hold. These ranges assume no major policy or payment shocks and normal promo pacing.

5.2 Sports (calendar shift & margin sensitivity)

U.S. demand stays anchored by NFL/NBA; in the U.K., with PL fixtures redistributed to Dec 27–28, we expect a two‑day handle plateau instead of a single Boxing Day spike. Operators should model multiple “favorite‑cover” sequences to understand the impact on December hold.

5.3 Distribution and discovery

Online retail grew 6.7% YoY in the 2024 holiday window—evidence that users search, compare, and transact digitally. Combine this with UK online session growth and you have strong odds of elevated site discovery and conversion in Dec 2025—if pages are timely, geocompliant, and fast.

6) Playbook for affiliates & operators — maximizing December iGaming profit

6.1 What to publish (and when)

- “December iGaming profit” hub: state‑by‑state legality (embed AGA/LSR), bonus matrix, RG links, and a rolling events ticker (NBA Christmas, NFL Wk 17–18, Bowls, Boxing Day racing; PL fixtures noted as 27–28 Dec cluster in 2025).

- Sports pages: live‑bet primers and props glossaries per game (NBA: alt lines, 3‑point props; NFL: SGP; Bowls: QB/RB yardage).

- Casino pages: quick‑deposit UX, visible cooldowns, and opt‑in session reminders; evergreen “best slots/live dealer” updated with December RTP/volatility callouts.

6.2 Offers & UX for the holiday user

- Low‑friction bonuses (simple rollover, clear deadlines across the holiday week); “countdown” clocks that avoid dark patterns.

- Live‑bet education components for NBA Christmas (in‑game runs = price swings), NFL clock management, and Bowl opt‑outs affecting props.

- Mobile‑first funnels: one‑tap betslip, Apple/Google Pay, and mini‑games that keep users engaged between live events.

6.3 Measurement, legality, and disclosures

- Server‑side attribution for iOS; UTM governance across email/push; CRM‑mapped deep links to preserve source data through app stores.

- Geo‑gating promos to legal states (map & trackers); #ad / affiliate disclosures above the fold; RG footer with helplines for every jurisdiction.

7) Modeling December iGaming profit: handle × hold × CAC

A practical way to price December is: Sports profit ≈ Handle × Hold − Promos − Ops; Casino profit ≈ NGR − Promos − Ops. December boosts the top line (Handle/Playable Sessions) but can compress sportsbook hold on favorite‑heavy slates. That’s precisely what happened in New York (Dec 2024)—massive handle (~$2.28B), but ~6.59% hold. Promo pacing should be front‑loaded to acquisition windows (Dec 20–26 in the U.S., Dec 27–28 in the U.K. this year), with retention features doing the monetization

8) Related guides on Aff Rate

- Affiliate Profit Analysis 2025 — EPC math, paid‑traffic CPMs, and portfolio strategy.

- Server‑Side Tracking for iOS 17 — regain attribution accuracy during peak holidays.

- Sports Betting — Operator Verticals — product nuances that impact hold.

9) Sources & official references

- New Jersey DGE — December 2024 monthly: Internet Gaming Win $228.0M (+26.5% YoY).

- Pennsylvania PGCB — December 2024 iGaming record $223.65M.

- UK Gambling Commission — operator data to Dec 2024 (Oct–Dec online GGY £1.54B, sessions 170M, avg 18m).

- Ontario (iGO) Q3 FY2024/25 — quarterly report and trade press summary (C$825.8M).

- NBA Christmas 2024 — 5.25M average viewers (+84% YoY); prime‑time game 7.76M.

- Premier League (Boxing Day 2025: one game only; others Dec 27–28).

- Mastercard SpendingPulse — holiday online +6.7% YoY; total retail +3.8%.

- U.S. legal footprint — 38 states + DC + PR; ~30 online.

- New York December 2024 — handle ~$2.28B; hold ~6.59%.

- GamCare / YouGov (Dec 2024): 59% of those experiencing harms are more likely to gamble at Christmas.

10) Takeaway

For operators and affiliates, December iGaming profit is a three‑variable function: audience availability, event inventory, and regulated reach. The 2022–2024 record shows December outperformance in online casino and sustained sports handle. For 2025, build state‑compliant pages early, time promos to the actual calendar (U.S. Dec 20–26; U.K. Dec 27–28), educate users on live‑betting mechanics, and underpin it with first‑party measurement and visible RG guardrails.