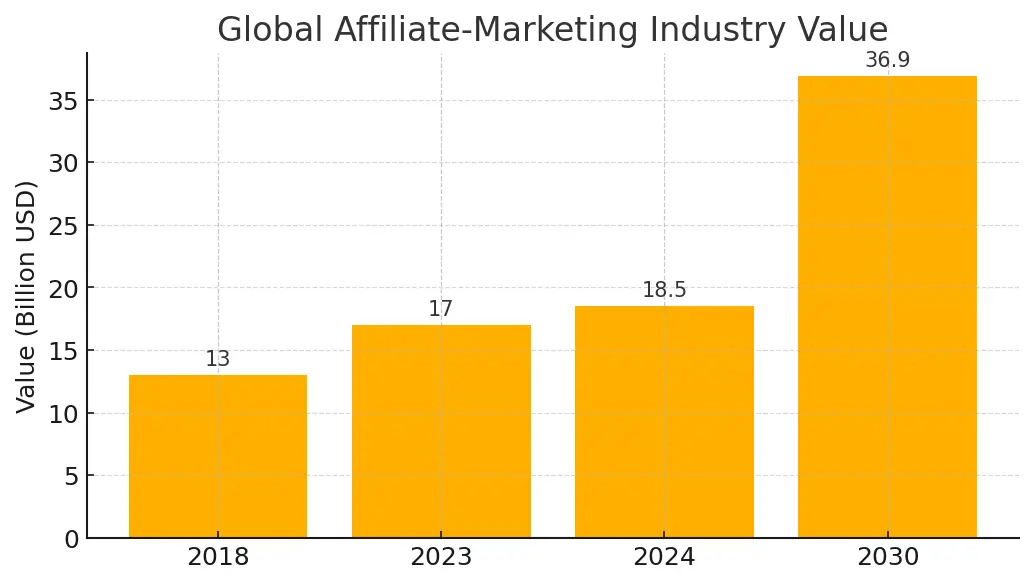

Ask any veteran webmaster: why affiliate earnings have grown since 2018, and you’ll hear dozens of theories—TikTok’s rise, SaaS subscription rev-share, iOS privacy changes, crypto gambling. All are partly true. Global affiliate spend climbed from $13 billion in 2018 to $18.5 billion in 2024, according to Influencer Marketing Hub , while U.S. programs alone more than doubled to $10.7 billion . Authority Hacker’s 2025 survey shows the median “full-time” affiliate now earns $8 038 per month, up from ~$2 700 in 2018 . This 3 000-word guide dissects ten structural shifts that drove the boom—rising ad CPMs, social-commerce checkouts, subscription economics, AI matchmaking, server-side tracking—and closes with a ten-step roadmap any publisher can follow to thrive through 2030.

1. Why Affiliate Earnings Have Grown Since 2018 – Market Metrics

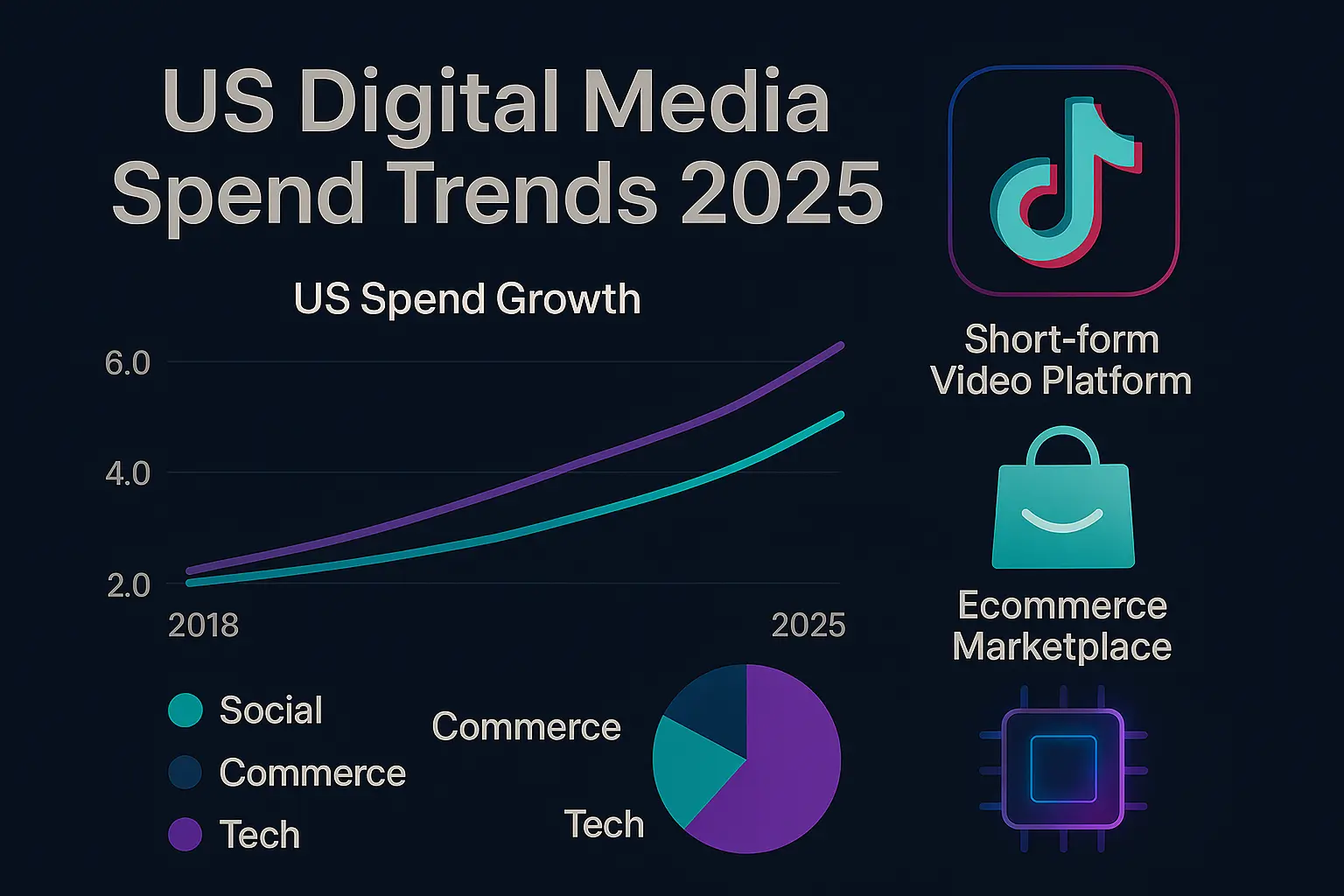

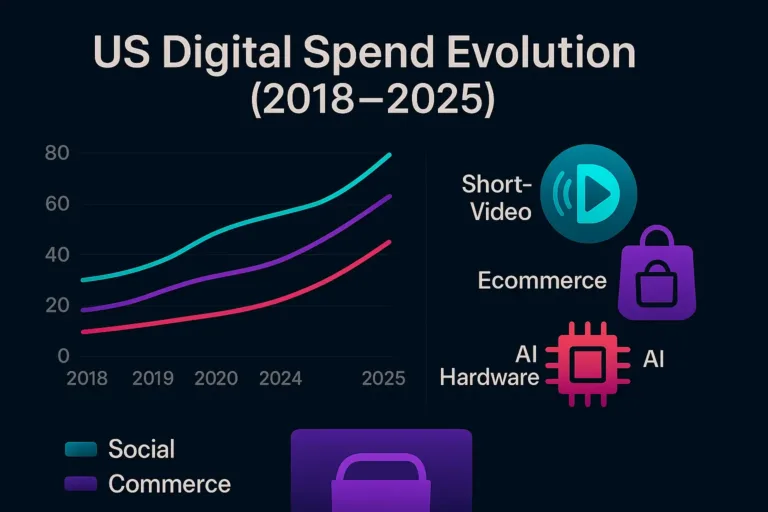

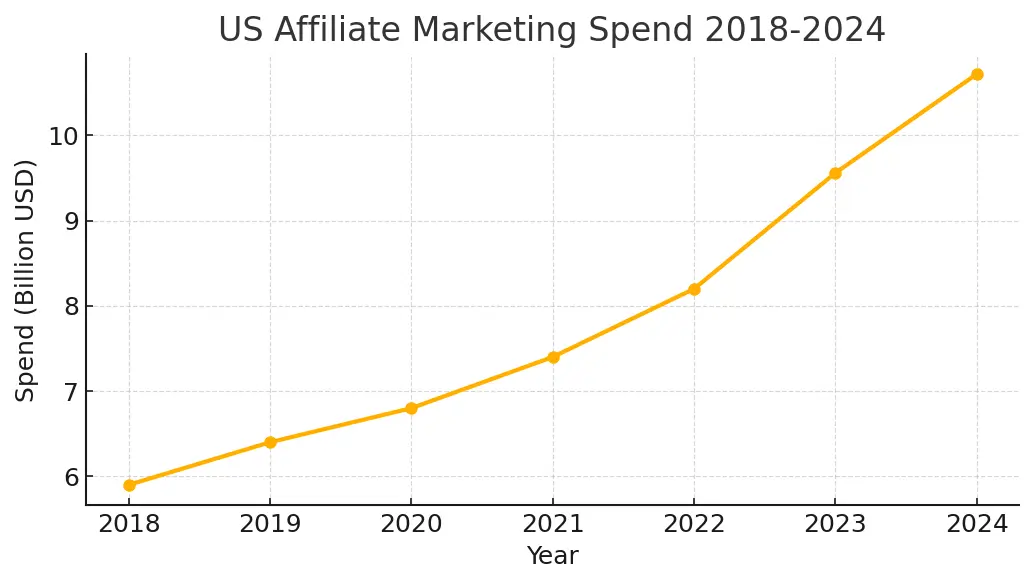

U.S. affiliate budgets rose from $5.9 billion in 2018 to $10.72 billion in 2024—a 76 % jump . Globally, Allied Market Research projects the industry will hit $36.9 billion by 2030 .

1.1 EPC Tripled – Why Affiliate Earnings Have Grown Since 2018

Authority Hacker’s biannual survey (2 700 respondents) lists a median EPC of $0.45 in 2018; by Q1-2025, that number reached $1.28 . Google’s Helpful Content update punishes thin coupon pages, leaving higher-quality sites to absorb share—and revenue.

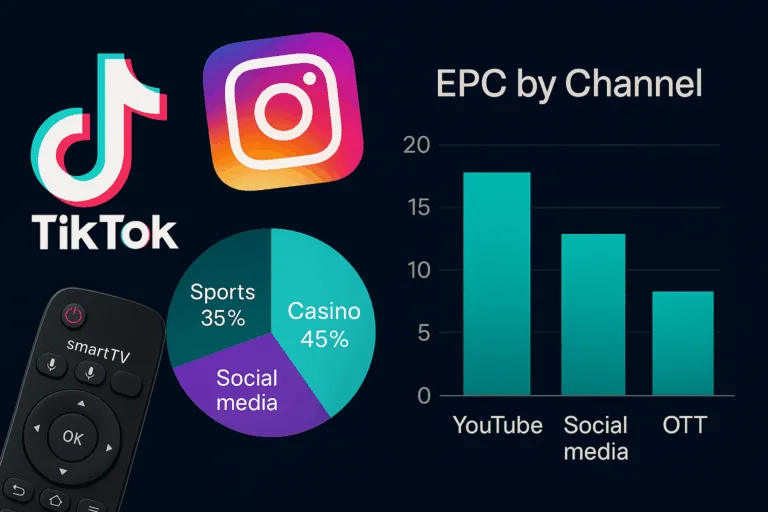

2. Rising Ad CPMs Push Brands Toward Pay-Per-Action

Facebook Ads CPM jumped from $5.12 (2018) to $10.45 (2024) . Google Shopping CPM climbed 45 % in the same window. Performance teams demanded ROI certainty and shifted budget to cost-per-action models—fuel for affiliate spend.

For a detailed CPM breakdown, see WordStream’s 2024 Google Ads benchmark report.

3. TikTok Shop & Social-Commerce Checkout Explosion

3.1 Live-stream sales convert up to 10 %

TikTok Shop now hosts 12 million sellers; ByteDance data shows live-stream add-to-cart rates as high as 10 %—tenfold higher than static PDPs . Affiliates plug into these one-tap checkouts and earn 1–20 % commission without paying CPC.

3.2 Instagram Product Tags & Reels

Meta’s 2024 roll-out of automatic affiliate product tags lets creators earn from every tap. Internal tests show 17 % higher cart rate when tags replace swipe-up links . Reels dominate 67 % of IG watch-time, delivering 1.6× EPC vs feed posts.

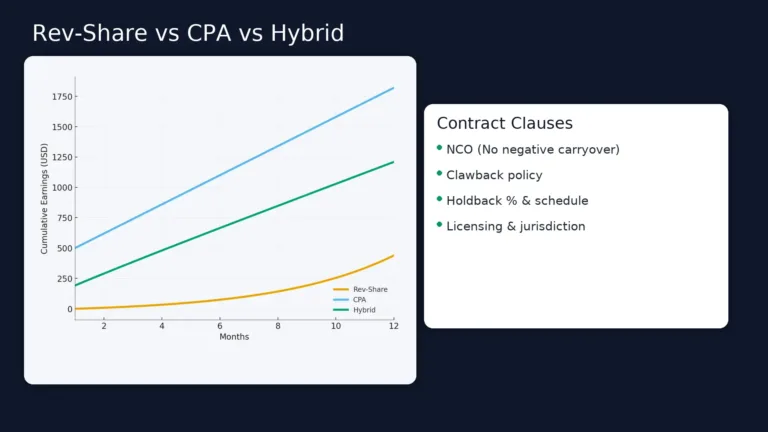

4. Subscription Models Turn One Click Into Lifetime Value

From Netflix to Notion, subscription ARPU scales with each renewal. PartnerStack reports a 41 % jump in SaaS programs since 2018 . A $65 CPA + 30 % rev-share hybrid can produce 4–6× more lifetime revenue than pure CPA, lifting aggregate EPC.

5. Crypto-Casino & U.S. Sports-Betting CPAs

Stake.com, Rollbit and BC.Game pay up to $250 CPA + 20 % net-gaming-rev. Meanwhile, newly regulated U.S. states triggered bidding wars: New York CPAs peaked at $350 per bettor in 2023 (EGR North America). High-ticket niches push the industry EPC curve upward.

6. AI Matchmaking & No-Code Publishing Slash Friction

Impact.com’s “Smart Match” scans site content and auto-invites relevant advertisers; partners report 30 % faster time-to-first-click. Carrd, Webflow and Ghost condense site launch time to hours, flooding the ecosystem with new—but ROI-driven—publishers.

7. Post-iOS 17 Server-Side Tracking Restores Conversions

Link-Tracking Protection hides UTMs. Voluum’s server-to-server setup recovers ≈12 % of previously “dark” conversions . Better attribution = confident bidding → higher EPC.

Need a step-by-step server-side setup? Our own guide iOS 17 & Affiliate Tracking walks through Voluum and Adjust postbacks.

8. Micro-Influencers Deliver Cheaper Engagement

Dash Hudson finds micro-influencers average 3.86 % engagement vs 1.21 % for mega-stars , and are happy with rev-share. Brands funnel savings into higher commission tiers, boosting affiliate upside.

9. New GEOs, New Income: LATAM & South-East Asia

Worldpay’s 2024 report shows digital-wallet penetration at 78 % in the Philippines and 73 % in Brazil. Local PSPs (Pix, GCash) unlock new traffic; affiliates who localise content reap first-mover EPC premiums.

10. Action Plan – Ride the Affiliate Earnings Boom Beyond 2018

- Diversify: cap any single vertical at 25 % of revenue.

- Recruit micro-influencers on a rev-share basis.

- Stream on TikTok Live; pin coupon code inside the chat.

- Test QR-driven CTV spots (≥7 s on screen).

- Migrate to server-side postbacks before Q3-2025.

- Add HowTo & FAQ schema for rich-result CTR +17 %.

- Refresh pillar guides quarterly for Google HCU compliance.

- Enable automated claw-back alerts (negative NGR).

- Translate high-value pages into Spanish, Hindi, Tagalog.

- Collect first-party email IDs—cookie-less future proofing.

11. Takeaway – Why Affiliate Earnings Have Grown Since 2018

Ad-platform inflation plus privacy shocks pushed brands toward predictable pay-per-action deals. Social-commerce checkout, subscription rev-share, crypto CPAs and AI automation multiplied EPC for publishers willing to adapt. Master hybrid commission models, omnichannel video, and server-side tracking, and the next six years could be even richer than the last.

Infographic

Sources

- Influencer Marketing Hub, “Affiliate Marketing Benchmark Report 2025.”

- Statista / Astute Analytica U.S. spend data 2018-2024.

- Allied Market Research, “Global Affiliate Market Forecast 2031.”

- Varos, Facebook Ads CPM Benchmarks 2024.

- TikTok Shop Seller Blog, April 2025.

- Meta / Shopify, “Instagram Product Tags ROI.”

- Authority Hacker Income Survey 2025.

- Dash Hudson, Micro-Influencer Performance Study 2024.

- Impact.com “Smart Match” Whitepaper 2024.

- Voluum Blog, “Server-Side Tracking Post-iOS 17.”

- Innovid, “CTV × Commerce 2024” report.

- LG Ad Solutions, “Shoppable TV Buyers 2025.”

- Harvard Business Review, “Omnichannel Order-Rate Uplift,” Dec 2024.

- Worldpay Global Payments Report 2024.

- EGR North America, “New York sports-betting CPA race,” Feb 2023.