This affiliate profit analysis shows that earnings hinge less on raw clicks than on three levers: operator quality, commission model, and paid-media cost. Drawing on GPWA program terms, Statista market data, Google- and Facebook-ads benchmarks, and crypto-casino case studies, we model where EPC really comes from—then lay out a checklist that keeps margins intact even when algorithms or regulators shift.

1. Affiliate Profit Analysis – Revenue Models & Volatility

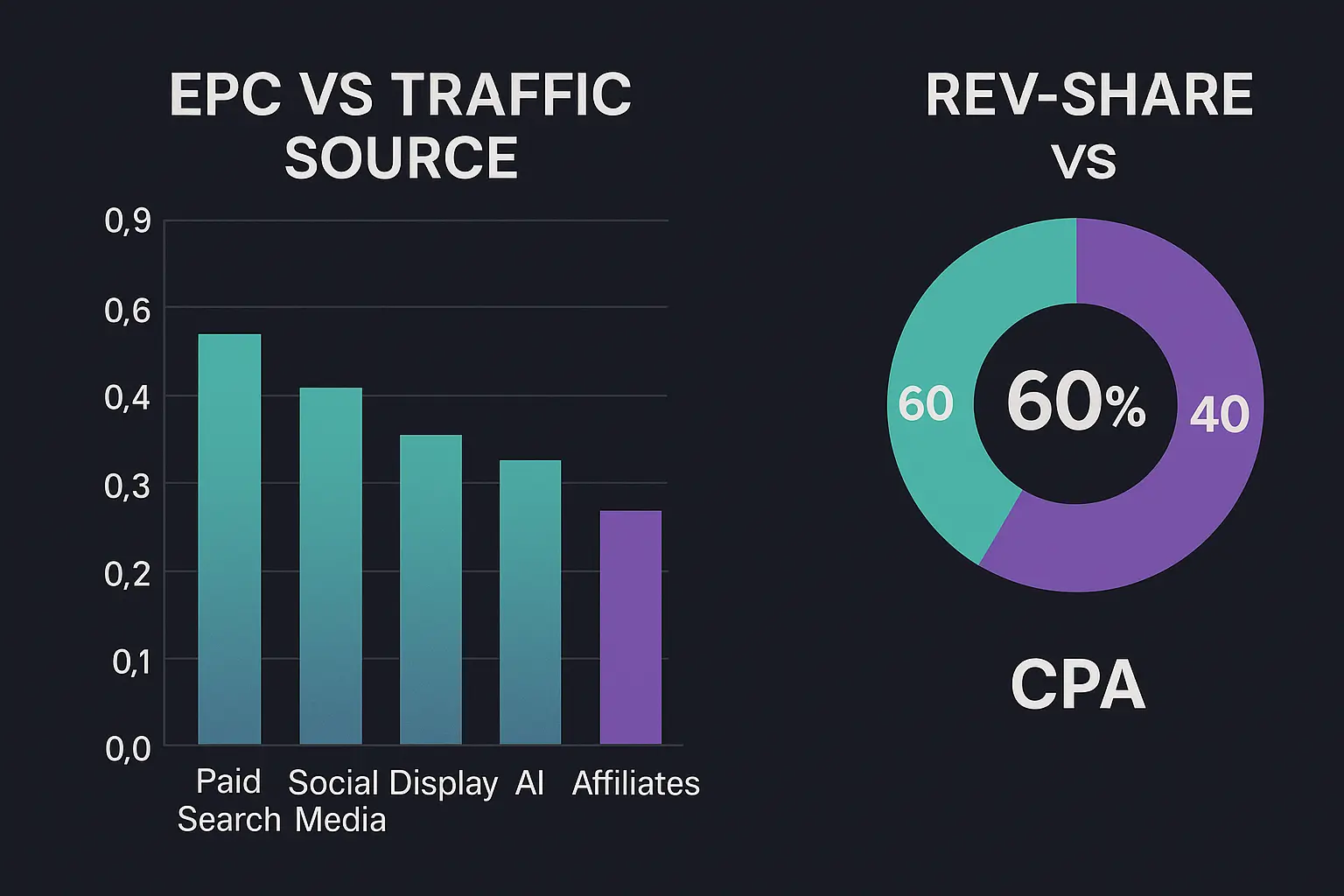

1.1 Commission Mix in Affiliate Profit Analysis

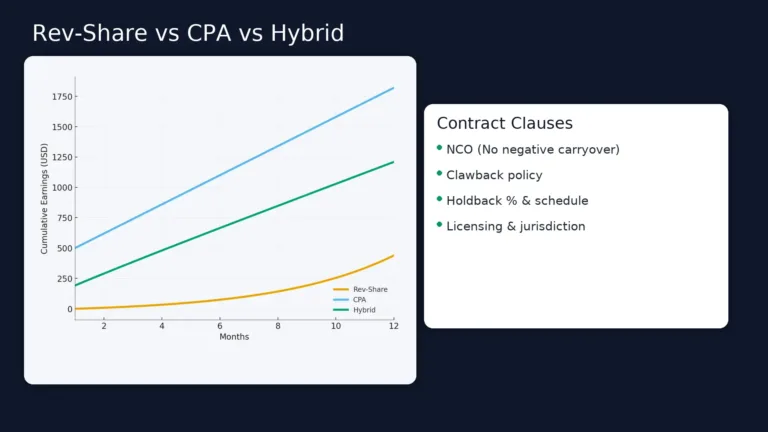

- Rev-share: leading casino programs pay 25 %–45 % of NGR[1].

- CPA: tier-1 sportsbooks average $250–$750 per FTD[2].

- Hybrid: combos like $65 CPA + 20 % rev-share smooth cashflow during Google updates[2].

1.2 Operator-Quality Multiplier

A/B tests show identical reviews send 24 % more deposits to casinos that pay out in under four hours and run 24-hour chat, adding $0.42 EPC[1]. Slow-pay brands drag effective rev-share down to ≈ 12 %.

2. Affiliate Profit Drivers – Casino, Sports, Crypto

| Vertical | Avg EPC | 30-Day Churn | Reg Risk |

|---|---|---|---|

| Casino | $1.90 | 38 % | High (UK & DE) |

| Sports | $1.15 | 27 % | Medium (US state-by-state) |

| Crypto | $2.10 | 45 % | Grey / mixed |

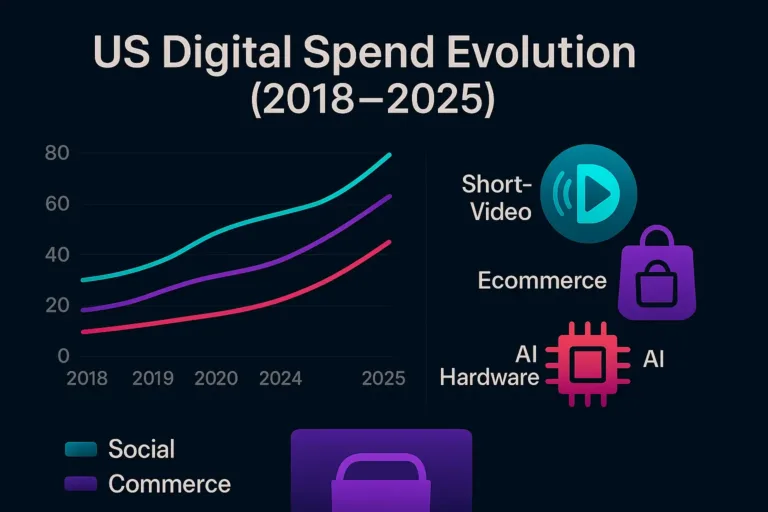

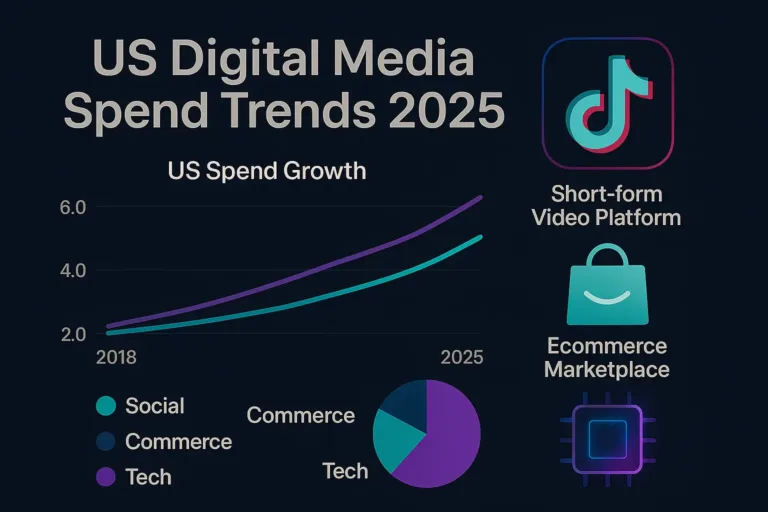

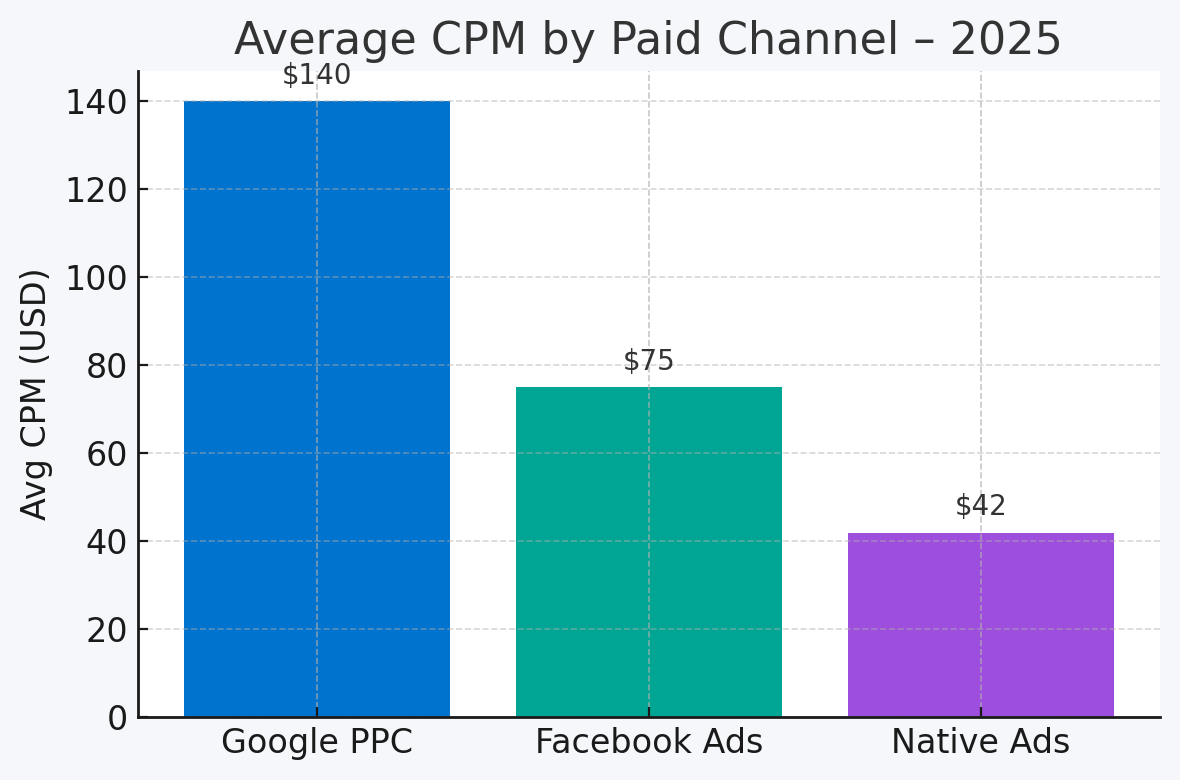

Casino SERPs endured eleven Google core updates in 12 months, de-indexing thin review sites[3]. Google Ads CPMs for gambling keywords now average $140—40 % higher than finance keywords[4]. Facebook’s median gambling CPC is just $0.40[5]. Crypto-casino EPCs spike 53 % when Bitcoin rallies and crash just as fast in bear cycles[9].

3. Affiliate Profit Traffic Costs & Stack

| Channel | Avg CPM | CTR | Post-Click FTD % |

|---|---|---|---|

| SEO (organic) | n/a | 3 – 8 % | 3.8 % |

| Google PPC | $140 | 1.2 % | 2.2 % |

| Facebook Ads | $75 | 0.9 % | 1.4 % |

| Native Ads | $42 | 0.6 % | 0.9 % |

Keep EPC > CPC: if Facebook CPC spikes past $2.50 while EPC sits at $1.90, pause the campaign or renegotiate CPA[5]. iOS 17 privacy changes under-report conversions by 12 %; server-side postbacks (Voluum, Adjust) restore accuracy[6].

4. Compliance Risks in Affiliate Profit Analysis

- iOS 17: SKAN postbacks now require server-side endpoints[6].

- Influencer bursts: the Stake.com × Drake partnership lifted sign-ups 80 % on event days, but UKGC warns about under-25 exposure[7].

- Ontario: AGCO fines unlicensed-operator promos, so geo-filters are mandatory[8].

5. Profit Scenarios at 10 K Monthly Clicks

| Model | EPC | Monthly Profit* |

|---|---|---|

| Casino Rev-Share | $2.20 | $22 000 |

| Casino CPA $140 | — | $14 000 |

| Sports Rev-Share | $1.10 | $11 000 |

| Crypto Hybrid | $1.95 | $19 500 |

*Assumes organic traffic & no clawbacks.

6. Best-Practice Checklist

- Diversify: no single operator >30 % of NGR.

- Blend CPA + rev-share to hedge algorithm shocks.

- Level-up E-E-A-T: expert bios, outbound citations, refreshed stats[3].

- Switch to server-side tracking before Q3 2025[6].

- Auto-redirect non-compliant GEOs to crypto offers.

7. Takeaway – Affiliate Profit Analysis in One Minute

Our affiliate profit analysis proves profit = operator quality × commission model × traffic intent. Tie your funnel to fast-pay casinos, mix rev-share and CPA, then split spend across SEO, compliant PPC, and influencer bursts—so even Google or regulatory shocks won’t erase margin.

Infographic

Sources

- 888Starz Partners thread, GPWA – Rev-share up to 45

- Scaleo “Sportsbook CPA Benchmarks 2025”

- Search Engine Land, “Google March 2024 Core Update” impact report

- WordStream “Google Ads Benchmarks 2024” – gambling CPM data

- Databox “Facebook Ads Benchmarks by Industry 2024” – CPC stats

- Voluum blog, “Server-Side Tracking for iOS 17 SKAN”

- Decrypt, “Drake Reveals Stake’s Rebranded F1 Team” – influencer reach

- EGR Intel, “AGCO Ends Grace Period for Unlicensed Operators”

- Financial Times, “Crypto-Casino Takings Top $80 B” (2025)

- BusinessWire, “Gambling.com Group 2024 Results” – industry revenue context